This is part of a series of features sponsored by Agents for Impact (AFI), a German impact investing firm whose products include the AFI Sustainability Alignment Rating (AFISAR©) Tool. The AFISAR© rating is a trust mark – in microfinance and other forms of social business – signifying a commitment to positive and enduring change for people and the planet based on the UN Sustainable Development Goal (SDG) framework.

This is part of a series of features sponsored by Agents for Impact (AFI), a German impact investing firm whose products include the AFI Sustainability Alignment Rating (AFISAR©) Tool. The AFISAR© rating is a trust mark – in microfinance and other forms of social business – signifying a commitment to positive and enduring change for people and the planet based on the UN Sustainable Development Goal (SDG) framework.

AFISAR© helps MFIs leverage the market’s growing focus on sustainability performance to raise capital from international investors and, particularly, impact investors. The rating helps investors and social businesses understand their strengths and weaknesses and devise effective strategies to minimize negative impact and maximize positive impact to the benefit of the organization – its employees, clients and other stakeholders – as well as the environment.

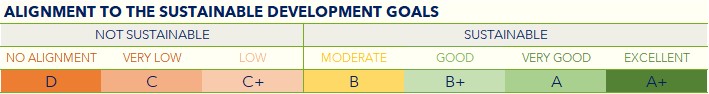

The active dialogue and engagement embedded in the AFISAR© rating process enables the MFI as well as asset managers to embark on a journey that leads to long-term sustainable development. A rating above the sustainability threshold on the scale (see below) is favorable for the disbursement funds. To date, AFI has used the AFISAR© Tool to rate 30+ microfinance and SME finance institutions in the Caucasus, Central and South Asia, East Africa and Eastern Europe, helping the institutions demonstrate their SDG competency and alignment.

Pratibha Singh (pictured): How did you become interested in microfinance?

Pratibha Singh (pictured): How did you become interested in microfinance?

Sergey Kim: My professional career started in 1998 in the field of microfinance. I was working as a loan officer for a UN microcredit project, which made it possible for me to have a close look at the ground-level realities concerning credit operations. After finishing my graduate degree, I chose FINCA because the job was close to people.

I have worked with FINCA since 2006 and have been in Tajikistan for the last 12 years. FINCA Tajikistan has been active since 2004 and is now amongst the top five MFIs in the country. We offer many financial products and services, such as loans, savings, deposits, money transfers, microinsurance and currency exchange. FINCA Tajikistan serves 30,000 customers through 26 branches. There is a significant need for microfinance in Tajikistan, as more than half of the country’s population lacks access to common financial services.

PS: What makes the FINCA model unique?

SK: For FINCA, the social mission is embedded in our values of warmth, trust and responsible banking. The segment of people that we work with has limited access to traditional banking services, and most of our customers are in remote, rural areas. At FINCA, we create trust in the banking system by giving people the tools, knowledge and confidence they need to build their financial health. We also are increasing digital service delivery to drive down costs and reach more people.

PS: What is at stake for an MFI like FINCA Tajikistan when it comes to the SDGs, and how does the MFI contribute to these goals?

SK: From the very beginning of my career, being out in the field, I understood how microfinance is critical to ending poverty because it gives people the ability to create their own futures. The pandemic has pushed more people back into poverty, especially women. In Tajikistan, 39 percent of our borrowers are women, and 80 percent of these women are the main income earners in their households.

We are also battling climate-related challenges in Tajikistan such as mudslides and extreme weather events that impact agricultural production. Around the world, people at the bottom of the economic pyramid will feel the biggest impacts of climate change, and we have to develop ways to support their resiliency and keep them in the financial system. We integrate these risks into our portfolio and make a point of communicating directly with our customers about their options.

PS: FINCA Tajikistan received an A rating on our AFISAR© rating scale (above), and USD 2 million were disbursed via Invest in Visions. Those are great results. How did the AFISAR© rating process unfold, and why did you decide to take it on?

SK: Undergoing the AFISAR© rating was the beginning of our partnership with AFI. The framework covers many aspects of our activities, including our social and environmental impact, our approach to staff and gender issues, and the protection of customer rights. The AFISAR© Tool has enabled us to better focus our efforts to improve our operations and ensure that we are meeting standards. We share the results with lenders, staff and customers to develop trust and attract more business.

PS: Please share a story of FINCA’s impact.

SK: The first customer who comes to mind is named Rustom. He was growing various fruits in his garden and owned a small piece of land for planting wheat and rice. He was active in agribusiness but doubted whether he could expand his business sustainably. He eventually chose to apply for a loan and was successful in expanding his agricultural production, including by raising livestock. The multidimensional impact of his loan is visible in his personal life, also, as he managed to provide a good education for his children and fund his daughter’s wedding.

SK: The first customer who comes to mind is named Rustom. He was growing various fruits in his garden and owned a small piece of land for planting wheat and rice. He was active in agribusiness but doubted whether he could expand his business sustainably. He eventually chose to apply for a loan and was successful in expanding his agricultural production, including by raising livestock. The multidimensional impact of his loan is visible in his personal life, also, as he managed to provide a good education for his children and fund his daughter’s wedding.

PS: How have you navigated the challenges of the past two years, and what are your plans to prepare for future uncertainty?

SK: For many years, we have operated in environments that frequently change and demand a certain resilience. However, COVID-19 created a level of uncertainty that we had never witnessed before. We first ensured that we had the resources that would allow us to continue our operations even as business ground to a halt.

We gathered a lot of data to analyse the impact on our customers, staff and portfolio performance while also evaluating the consequences of government action. This helped us respond in a way that protected our customers. We had a clear lending strategy and reevaluated our risk tolerance levels for some customer segments, leading to the restructuring of some customer loans. The key here was transparent communication to all stakeholders.

We will continue to deal with the consequences for some time. It’s important for microfinance stakeholders to create more resiliency within the sector to absorb these kinds of shocks while keeping MFIs and their customers financially healthy.

PS: What is your advice to other MFIs that have yet not embarked on the sustainability pathway?

SK: MFIs’ customers tend to be the most vulnerable to the impacts of the current global challenges. If we aren’t effective, inequality will grow, and our mission will be compromised. Microfinance impacts individuals, but it also contributes to national political and economic stability, which is critical for addressing climate change and reducing poverty. I believe we need to incorporate continuous evolution into all aspects of the company to adapt and respond to changing threats and opportunities. As we improve staff and governance capacity and enhance the customer experience, we will be a stronger institution.

Curious about the AFISAR© rating? Then drop us a line at pratibha.singh@agentsforimpact.com.

Similar Posts:

- SPECIAL REPORT: Looking Back to Plan Ahead – The Year of AFISAR

- MICROCAPITAL BRIEF: Jeff Flowers to Lead FINCA Impact Finance

- SPECIAL REPORT: Agents for Impact – We Make Positive Impact Investable!

- SPECIAL REPORT: Agents for Impact: Well-equipped for Future Business Development

- SPECIAL REPORT: Partner with Agents for Impact, and We’ll Drive Impact Together!