This article is sponsored by Agents for Impact (AFI). We invite you to learn more about the firm via LinkedIn.

Andrij Fetsun, Founder & CEO at AFI:

Andrij Fetsun, Founder & CEO at AFI:

AFI celebrated five years in business in October this year, and my team has attained several impactful goals during this challenging time. This would not have been possible without the immense support of our clients: the German impact-driven microfinance fund Invest in Visions, which has accumulated a volume of around EUR 1 billion with a major focus on microfinance; HANSAINVEST, which is based in Hamburg; and the crowdfunding platform Lendahand. Among the services we provide these clients is to perform plausibility checks of their funds’ ESG reports.

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace – values and culture. Personal growth and company growth need to go hand-in-hand. I have endeavored to let all my team members take ownership of their personal growth as they propel the company forward. I am proud to state that AFI unites nine nationalities, where each Agent’s life has been positively changed by being associated with AFI, and we, in turn, have been enriched by their presence.

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace – values and culture. Personal growth and company growth need to go hand-in-hand. I have endeavored to let all my team members take ownership of their personal growth as they propel the company forward. I am proud to state that AFI unites nine nationalities, where each Agent’s life has been positively changed by being associated with AFI, and we, in turn, have been enriched by their presence.

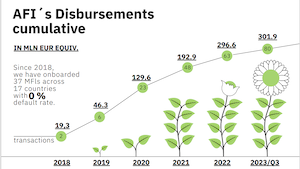

We at AFI aim to be highly accessible to our clients (35 MFIs in 17 countries so far), virtually as well as on-site, and to continue being trustworthy and capable advisors to them. As a result, our portfolio has generated EUR 29 million in interest for our investors with 0 percent default since 2018. This – in addition to the social impact – we are very proud of!

Andrii Tiurenkov, Director of Debt Investments:

Andrii Tiurenkov, Director of Debt Investments:

Andrii Tiurenkov’s position is central to AFI’s strategy of advancing sustainable finance in emerging and frontier markets. This work strongly aligns with several UN Sustainable Development Goals (SDGs), such as financial inclusion and entrepreneurship.

When we launched our firm five years ago, AFI’s challenge was clear: to build an investment process from the ground up. To meet this objective, Andrii set the investment agenda, designed tools to achieve KPIs, developed risk-assessment protocols and built relationships with potential investees. The management of investment operations at AFI involves overseeing a wide range of tasks, including origination, due diligence and fund disbursement. Andrii’s strategic guidance and operational management have resulted in a portfolio that is both financially solid and strongly aligned with sustainability goals.

Under his leadership, the team has channeled EUR 300 million to 35 MFIs in 17 countries. However, Andrii’s role at AFI goes beyond the job title; it’s about leading the way in responsible investments that produce both financial and sustainable outcomes.

Shreya Shankar, Head of Legal & Compliance:

Shreya Shankar, Head of Legal & Compliance:

AFI’s legal team is proudly helmed by Shreya Shankar, a lawyer who was recently honored as one of India’s top women chief legal officers by Women Entrepreneur India. Our legal team is razor-sharp in its focus on delivering quality AML-KYC compliance and transactional legal support to its impact investor clients seeking debt opportunities in emerging markets across the world. Both of AFI’s lawyers are from India and bring expertise in Indian debt and equity transactions that is a great asset to the company as well as the clients we represent. Aside from providing end-to-end support on transactions, we also provide technical assistance tailor-made to each client’s requirements.

Shreya notes, “Our team’s expertise in Indian laws can be of great help to impact investors looking to India for investment opportunities. And I am excited to see how we can expand our support beyond debt financing in this country.”

Yannick Rust, Director of Sustainability Rating & Risk:

Yannick Rust, Director of Sustainability Rating & Risk:

Yannick Rust heads AFI’s Rating and Risk division with a deep-rooted passion for sustainability and impact measurement, drawn from nearly a decade of experience in impact investing and international development frameworks, such as the SDGs and the MDGs before them. He joined AFI shortly after its founding in March 2019 and codeveloped our in-house sustainability tool AFISAR© in collaboration with an expert from Moody’s. During the past several years, he has honed his expertise in 17 countries across Southeast Asia and South America.

As of today, the rating team has evaluated over 100 MFIs in eight countries through its flagship product AFISAR©. For 2024, we are adding new features to AFISAR© that align with the latest SFDR requirements, including enhanced PAI reporting and AI-driven improvements in data collection and user experience.

Also during 2024, AFI’s rating team is gearing up to extend its consultancy services to financial institutions in developing markets, following two successful projects with top German asset managers.

Yannick reports, “As the Rating and Risk team, we are looking to 2024 with enthusiasm for the new capabilities of AFISAR© and our expanding consulting services, all aimed at bolstering long-term sustainability for our partners.”

Similar Posts:

- SPECIAL REPORT: Agents for Impact – We Make Positive Impact Investable!

- SPECIAL REPORT: Agents for Impact: Well-equipped for Future Business Development

- SPECIAL REPORT: Looking Back to Plan Ahead – The Year of AFISAR

- SPECIAL REPORT: Inclusivity in Capital Markets Demands Sustainability Reporting

- SPECIAL REPORT: Leveraging Carbon Credits to Insure MSMEs in Climate-vulnerable Nations #SAM2023