The France-based NGO Just Sustainability Transitions (JuST) Institute is holding an online session December 12 to educate potential participants about a mentoring and training program for financial services providers (FSPs) looking to orient their work toward “climate adaptation and biodiversity conservation.” The program, which is for loan officers and managers employed by microfinance institutions (MFIs), takes place online over a period of four to six months. Participation can be part of an MFI becoming certified for

The France-based NGO Just Sustainability Transitions (JuST) Institute is holding an online session December 12 to educate potential participants about a mentoring and training program for financial services providers (FSPs) looking to orient their work toward “climate adaptation and biodiversity conservation.” The program, which is for loan officers and managers employed by microfinance institutions (MFIs), takes place online over a period of four to six months. Participation can be part of an MFI becoming certified for

Category: Trends/Challenges

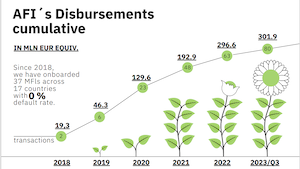

SPECIAL REPORT: Partner with Agents for Impact, and We’ll Drive Impact Together!

This article is sponsored by Agents for Impact (AFI). We invite you to learn more about the firm via LinkedIn.

Andrij Fetsun, Founder & CEO at AFI:

Andrij Fetsun, Founder & CEO at AFI:

AFI celebrated five years in business in October this year, and my team has attained several impactful goals during this challenging time. This would not have been possible without the immense support of our clients: the German impact-driven microfinance fund Invest in Visions, which has accumulated a volume of around EUR 1 billion with a major focus on microfinance; HANSAINVEST, which is based in Hamburg; and the crowdfunding platform Lendahand. Among the services we provide these clients is to perform plausibility checks of their funds’ ESG reports.

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

MICROFINANCE PAPER WRAP-UP: “Gendered Investment Differences Among Smallholder Farmers: Evidence from a Microcredit Programme in Western Kenya,” by Keiji Jindo et al

The authors of this study conducted a client-level analysis to examine differences in the investment behavior of female and male microcredit users in Kenya. The scope included

The authors of this study conducted a client-level analysis to examine differences in the investment behavior of female and male microcredit users in Kenya. The scope included

SPECIAL REPORT: Leveraging Financial Inclusion to Get Food Security Back on the Increase #EMW2023

Global food security had been increasing before the COVID-19 pandemic and the invasion of Ukraine by Russia. People with low incomes were becoming more able to access – both in terms of cost and distance – a range of foods such as grains and fresh produce on a year-round basis. However, during the first year of COVID-19, 47 million women fell into extreme poverty, reducing their – and their children’s – access to

Global food security had been increasing before the COVID-19 pandemic and the invasion of Ukraine by Russia. People with low incomes were becoming more able to access – both in terms of cost and distance – a range of foods such as grains and fresh produce on a year-round basis. However, during the first year of COVID-19, 47 million women fell into extreme poverty, reducing their – and their children’s – access to

SPECIAL REPORT: European Microfinance Week 2023 Opens With Action Group Meetings, Including Investors Sharing Strategies for Measuring Social Performance #EMW2023

The first day of European Microfinance Week 2023 began this morning with meetings of several of the European Microfinance Platform’s (e-MFP’s) Action Groups. At the Investors Action Group session, Cécile Lapenu of CERISE discussed the recent increase in demand for accountability regarding claims of positive client impact. What really makes an investor an impact investor? How can we measure impact in a way that is convincing and also efficient?

The first day of European Microfinance Week 2023 began this morning with meetings of several of the European Microfinance Platform’s (e-MFP’s) Action Groups. At the Investors Action Group session, Cécile Lapenu of CERISE discussed the recent increase in demand for accountability regarding claims of positive client impact. What really makes an investor an impact investor? How can we measure impact in a way that is convincing and also efficient?

The recently published 60 Decibels Microfinance Index 2023 addresses some of these questions. The study, which is based on a survey of 32,000 microfinance clients in 32 countries, indicates that access to financial and non-financial services other than credit leads to deeper impact. Regarding credit services, group lending is associated with

MICROFINANCE PAPER WRAP-UP: “The Global State of Financial Inclusion and Consumer Protection 2022,” by Buddy Buruku et al, published by the World Bank Group

This update of similar reports published in 2013 and 2017 covers legal and regulatory issues related to financial inclusion and consumer protection across the world. The authors surveyed financial regulators and supervisors across 130 economies.

This update of similar reports published in 2013 and 2017 covers legal and regulatory issues related to financial inclusion and consumer protection across the world. The authors surveyed financial regulators and supervisors across 130 economies.

MICROCAPITAL BRIEF: ABI to Leverage $69m from EIB to Boost SME, Mid-cap Financing in West Africa – Focusing on Women, Youth

Atlantic Business International (ABI), a holding company owned by the Morocco-based Banque Centrale Populaire (BCP) Group, recently entered an agreement with the EU’s European Investment Bank (EIB) whereby EIB will fund half of EUR 130 million (USD 138 million) in funding to be distributed via ABI’s Banque Atlantique institutions in Burkina Faso, Côte d’Ivoire and Senegal. The funds are to be directed to small and medium-sized enterprises (SMEs) and mid-caps with the goal of

Atlantic Business International (ABI), a holding company owned by the Morocco-based Banque Centrale Populaire (BCP) Group, recently entered an agreement with the EU’s European Investment Bank (EIB) whereby EIB will fund half of EUR 130 million (USD 138 million) in funding to be distributed via ABI’s Banque Atlantique institutions in Burkina Faso, Côte d’Ivoire and Senegal. The funds are to be directed to small and medium-sized enterprises (SMEs) and mid-caps with the goal of

MICROFINANCE PAPER WRAP-UP: “Mobile Money, Interoperability and Financial Inclusion;” by Markus K Brunnermeier et al; published by National Bureau of Economic Research (NBER)

In this paper, the authors examined the effects of platform interoperability on competition and financial inclusion in Africa. In particular, they studied interoperability among mobile money operators, a mechanism that allows users to transfer money between different mobile money providers and across mobile networks.

In this paper, the authors examined the effects of platform interoperability on competition and financial inclusion in Africa. In particular, they studied interoperability among mobile money operators, a mechanism that allows users to transfer money between different mobile money providers and across mobile networks.

MICROFINANCE PAPER WRAP-UP: “2023 Microfinance Index Report,” Published by 60 Decibels

This report provides insight into the experience of financial services provider (FSP) clients, including quantitative comparisons of FSPs across regions and snapshots of FSP performance in Cambodia, Ecuador, India, Indonesia and Uganda.

This report provides insight into the experience of financial services provider (FSP) clients, including quantitative comparisons of FSPs across regions and snapshots of FSP performance in Cambodia, Ecuador, India, Indonesia and Uganda.

The authors constructed the dataset from

SPECIAL REPORT: Inclusivity in Capital Markets Demands Sustainability Reporting

Sustainability reporting entails assessing, disclosing and managing an organization’s environmental, social and governance (ESG) impacts. This practice communicates to investors, customers, employees and regulators that the organization is committed to sustainability. The disclosure element, in particular, conveys values, strategies, risks, opportunities, accountability and transparency.

Sustainability reporting entails assessing, disclosing and managing an organization’s environmental, social and governance (ESG) impacts. This practice communicates to investors, customers, employees and regulators that the organization is committed to sustainability. The disclosure element, in particular, conveys values, strategies, risks, opportunities, accountability and transparency.

The significance of sustainability reporting within capital markets is increasing steadily, as more investors

SPECIAL REPORT: e-MFP Launches the Green Map, a Pioneering Resource to Address an Information Gap in Green Inclusive Finance

As the inclusive finance sector increasingly understands the crucial role it can have in supporting the most vulnerable populations – who are disproportionately affected by the consequences of climate change – the European Microfinance Platform (e-MFP) is delighted to announce the launch of the Green Map, a project implemented by the e-MFP Green Inclusive and Climate Smart Finance Action Group (GICSF-AG) and supported by the Government of the Grand-Duchy of Luxembourg. The Green Map was officially launched on Thursday, September 28 at an in-person and live-streamed event entitled “Addressing Climate Change via an Open Resource for Green Inclusive Finance Projects & Practices.”

As the inclusive finance sector increasingly understands the crucial role it can have in supporting the most vulnerable populations – who are disproportionately affected by the consequences of climate change – the European Microfinance Platform (e-MFP) is delighted to announce the launch of the Green Map, a project implemented by the e-MFP Green Inclusive and Climate Smart Finance Action Group (GICSF-AG) and supported by the Government of the Grand-Duchy of Luxembourg. The Green Map was officially launched on Thursday, September 28 at an in-person and live-streamed event entitled “Addressing Climate Change via an Open Resource for Green Inclusive Finance Projects & Practices.”

What’s this all for? The Green Map project aims to

MICROFINANCE PAPER WRAP-UP: “State of the Art of Green Inclusive Finance 2011-2019: Worldwide Status and Progress Over 10 Years,” by e-MFP Green Inclusive and Climate Smart Finance Action Group

The authors of this paper assess the evolution of the green inclusive finance sector from 2011 to 2019. This encompasses products offered by a range of types of financial services providers (FSPs), including climate insurance

The authors of this paper assess the evolution of the green inclusive finance sector from 2011 to 2019. This encompasses products offered by a range of types of financial services providers (FSPs), including climate insurance

MICROCAPITAL BRIEF: Okra Solar of Nigeria Raises Equity, Debt Totaling $12m to Expand Mesh Grids in Africa, Americas, Asia

Nigeria-based Okra Solar, whose products serve 14,000 people in Cambodia, Haiti, Nigeria, and the Philippines, recently raised USD 8 million in equity from five investors. The investment package is led by US-based At One Ventures and includes USD 1.5 million from

Nigeria-based Okra Solar, whose products serve 14,000 people in Cambodia, Haiti, Nigeria, and the Philippines, recently raised USD 8 million in equity from five investors. The investment package is led by US-based At One Ventures and includes USD 1.5 million from

MICROCAPITAL BRIEF: Money Fellows of Egypt Borrowing $2.2m from Symbiotics to Support Digital ROSCAs

Symbiotics Investments, a Switzerland-based investor focused on smaller businesses in low- and middle-income countries, recently issued a loan of USD 2.25 million to Egypt-based Money Fellows. Money Fellows plans to use the fresh capital to expand its digitization of rotating savings and credit associations (ROSCAs), also known as money circles, as well as to broaden

Symbiotics Investments, a Switzerland-based investor focused on smaller businesses in low- and middle-income countries, recently issued a loan of USD 2.25 million to Egypt-based Money Fellows. Money Fellows plans to use the fresh capital to expand its digitization of rotating savings and credit associations (ROSCAs), also known as money circles, as well as to broaden

MICROFINANCE PAPER WRAP-UP: “Climate Risk and Financial Inclusion: A Regulatory Perspective on Risks and Opportunities;” by Peter Knaack, Peter Zetterli

This paper analyzes how climate change may impact the stability of financial systems and – particularly – access to financial services for groups that often have difficulty with such access, including micro- and small enterprises (MSEs) as well as low-income households and those in rural areas. The authors emphasize three challenges:

This paper analyzes how climate change may impact the stability of financial systems and – particularly – access to financial services for groups that often have difficulty with such access, including micro- and small enterprises (MSEs) as well as low-income households and those in rural areas. The authors emphasize three challenges:

SPECIAL REPORT: An Interview with Christoph Pausch of e-MFP on European Microfinance Week, Luxembourg & Online, November 2023

MicroCapital: What can we expect from EMW2023, happening in-person November 15-17 in Luxembourg and online?

MicroCapital: What can we expect from EMW2023, happening in-person November 15-17 in Luxembourg and online?

Christoph Pausch: EMW2022, back in-person after two years, showed us that there is no substitute for getting the opinion leaders and decision-makers in the inclusive finance sector together in-person, ensuring they have the time and space to debate, make new connections, and of course give presentations and discuss the various challenges and innovations underway around the world.

After the success of the hybrid EMW2022, which gathered 570 attendees (including over 200 who joined us online) from 48 countries, we are delighted to return to the beautiful Abbaye de Neumunster in Luxembourg for another hybrid event, which will once again offer an exceptional networking and knowledge-sharing experience with the top experts in the financial inclusion sector. And the programme is designed to be as conducive as possible to those joining us online from different time zones. Plus, sessions will be recorded for “catch-up” after.

MC: What choices of sessions can attendees expect?

CP: As always, EMW sessions have been put forward largely by our members – so they address the sector’s current “hot topics” – and we organise them across several thematic streams. We received an enormous response to our call for proposals that went out early in the summer, giving us great scope for a fascinating, diverse program across different streams. In addition to our usual annual topic areas – digitisation, social performance, funding/investment – this year there also will be streams on refugee finance, agri-finance, a particular emphasis on

MICROFINANCE PAPER WRAP-UP: “Agritech and Fintech Providers in East and Southern Africa: A Landscape Assessment;” published by IFAD, SAFIN

The authors of this paper address: (1) the environment that financial institutions in East and Southern Africa (ESA) face when lending to agricultural micro-, small and medium-sized enterprises (MSMEs); and (2) how this lending can be increased via agricultural technology (agritech) and financial technology (fintech) firms. The challenges include

The authors of this paper address: (1) the environment that financial institutions in East and Southern Africa (ESA) face when lending to agricultural micro-, small and medium-sized enterprises (MSMEs); and (2) how this lending can be increased via agricultural technology (agritech) and financial technology (fintech) firms. The challenges include

MICROFINANCE EVENT: SAM (Semaine Africaine de la Microfinance); October 16-20, 2023; Lomé, Togo

Themed “Inclusive and Sustainable Finance: How to Reconcile the Challenges of Socio-economic Inclusion and the Transition to a Resilient and Ecological Economy,” this sixth edition of SAM (Semaine Africaine de la Microfinance, French for African Microfinance Week) includes two days each of conference sessions, an Investor Fair and an “Innovator’s Village,” along with a gala dinner and about 20 associated events on topics such as “agricultural finance, digital finance, microinsurance and social performance.”

Themed “Inclusive and Sustainable Finance: How to Reconcile the Challenges of Socio-economic Inclusion and the Transition to a Resilient and Ecological Economy,” this sixth edition of SAM (Semaine Africaine de la Microfinance, French for African Microfinance Week) includes two days each of conference sessions, an Investor Fair and an “Innovator’s Village,” along with a gala dinner and about 20 associated events on topics such as “agricultural finance, digital finance, microinsurance and social performance.”

The conference portion of the week includes sessions titled: (1) Carbon Markets and Environmental Service Payments: New Opportunities for Local Communities; (2) Beyond Taxonomies: the Role of