The multilateral Asian Development Bank (ADB) recently raised AZN 14.5 million (USD 8.5 million) from UK-based Record Currency Management and Germany-based Capitulum Asset Management to fund inclusive finance for women and agriculture in Azerbaijan. The funding is channeled through

The multilateral Asian Development Bank (ADB) recently raised AZN 14.5 million (USD 8.5 million) from UK-based Record Currency Management and Germany-based Capitulum Asset Management to fund inclusive finance for women and agriculture in Azerbaijan. The funding is channeled through

Category: South Asia, East Asia and Pacific

MICROCAPITAL BRIEF: Grab Adds MoMo as Mobile Payment Option for Ride-sharing, Deliveries, Digital Financial Services in Vietnam

Singapore-based Grab recently added the payment solution of Vietnam’s MoMo to its “super-app” so that Grab customers in Vietnam have an additional option for making cashless payments for services such as hailing a motorbike, shopping online, ordering meal delivery or buying insurance. MoMo allows users to send funds from

Singapore-based Grab recently added the payment solution of Vietnam’s MoMo to its “super-app” so that Grab customers in Vietnam have an additional option for making cashless payments for services such as hailing a motorbike, shopping online, ordering meal delivery or buying insurance. MoMo allows users to send funds from

MICROCAPITAL BRIEF: Opportunity EduFinance Partners with 7 FSPs to Invest in Education in Africa, India

Opportunity EduFinance, an affiliate of the US-based NGO Opportunity International, recently brought on seven new financial services provider (FSP) partners, with whom it plans to invest in affordable private education in India, Nigeria and Rwanda. Although the FSPs have not been identified publicly, they are expected to

Opportunity EduFinance, an affiliate of the US-based NGO Opportunity International, recently brought on seven new financial services provider (FSP) partners, with whom it plans to invest in affordable private education in India, Nigeria and Rwanda. Although the FSPs have not been identified publicly, they are expected to

MICROCAPITAL BRIEF: JuST Institute Preview of Training on Delivering Climate, Biodiversity & Inclusive Finance to Smallholder Farmers Available Online December 12, 2023

The France-based NGO Just Sustainability Transitions (JuST) Institute is holding an online session December 12 to educate potential participants about a mentoring and training program for financial services providers (FSPs) looking to orient their work toward “climate adaptation and biodiversity conservation.” The program, which is for loan officers and managers employed by microfinance institutions (MFIs), takes place online over a period of four to six months. Participation can be part of an MFI becoming certified for

The France-based NGO Just Sustainability Transitions (JuST) Institute is holding an online session December 12 to educate potential participants about a mentoring and training program for financial services providers (FSPs) looking to orient their work toward “climate adaptation and biodiversity conservation.” The program, which is for loan officers and managers employed by microfinance institutions (MFIs), takes place online over a period of four to six months. Participation can be part of an MFI becoming certified for

MICROFINANCE PAPER WRAP UP: “Women Agents for Financial Inclusion: Exploring the Benefits, Constraints and Potential Solutions,” by Emilio Hernandez et al, Published by CGAP

Based on data collected from projects in India, Ghana and Pakistan that aim to improve financial inclusion for rural women, the authors examine the interplay between gender dynamics and the employment of women as agents supplying in cash-in and cash-out (CICO) services. This includes the impact these agents can have on communities, the challenges faced by women in becoming and succeeding as agents, and possible solutions to these challenges.

Based on data collected from projects in India, Ghana and Pakistan that aim to improve financial inclusion for rural women, the authors examine the interplay between gender dynamics and the employment of women as agents supplying in cash-in and cash-out (CICO) services. This includes the impact these agents can have on communities, the challenges faced by women in becoming and succeeding as agents, and possible solutions to these challenges.

While training to become CICO agents,

SPECIAL REPORT: Partner with Agents for Impact, and We’ll Drive Impact Together!

This article is sponsored by Agents for Impact (AFI). We invite you to learn more about the firm via LinkedIn.

Andrij Fetsun, Founder & CEO at AFI:

Andrij Fetsun, Founder & CEO at AFI:

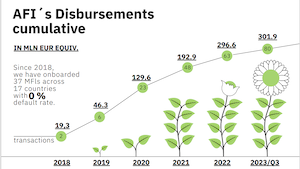

AFI celebrated five years in business in October this year, and my team has attained several impactful goals during this challenging time. This would not have been possible without the immense support of our clients: the German impact-driven microfinance fund Invest in Visions, which has accumulated a volume of around EUR 1 billion with a major focus on microfinance; HANSAINVEST, which is based in Hamburg; and the crowdfunding platform Lendahand. Among the services we provide these clients is to perform plausibility checks of their funds’ ESG reports.

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

MICROFINANCE EVENT: Livelihoods India Summit; January 17-18, 2024; New Delhi, India

The goal of this event is “to facilitate a dialogue on impacting livelihoods of the poor.” The discussion topics will include value chains,

The goal of this event is “to facilitate a dialogue on impacting livelihoods of the poor.” The discussion topics will include value chains,

MICROFINANCE EVENT: Singapore FinTech Festival; November 15-17, 2023; Singapore

The goal of this event is to serve as a “global nexus where policy, finance and technology communities converge,” including to discuss new financial products;

The goal of this event is to serve as a “global nexus where policy, finance and technology communities converge,” including to discuss new financial products;

MICROCAPITAL BRIEF: Opportunity International, UPS Foundation Announce “Unstoppable Women Initiative” to Expand Financial Services in Colombia, India, Indonesia, Nigeria

Two US-based NGOs, Opportunity International and the UPS Foundation, recently partnered to launch the Unstoppable Women Initiative to support female entrepreneurs in underserved communities in Colombia, India, Indonesia and Nigeria. The program includes training, business support and

Two US-based NGOs, Opportunity International and the UPS Foundation, recently partnered to launch the Unstoppable Women Initiative to support female entrepreneurs in underserved communities in Colombia, India, Indonesia and Nigeria. The program includes training, business support and

MICROFINANCE EVENT: TiE Summit Global; November 15-17, 2023; Singapore

The annual TiE Global Summit, held alongside the Singapore Fintech Festival, centers around the theme of leveraging entrepreneurship to create “#GoodForTheWorld.” The event will cover areas of interest such as:

The annual TiE Global Summit, held alongside the Singapore Fintech Festival, centers around the theme of leveraging entrepreneurship to create “#GoodForTheWorld.” The event will cover areas of interest such as:

MICROFINANCE EVENT: Global Inclusive Finance Summit; December 12-13, 2023; New Delhi, India

This event, formerly known as the Inclusive Finance India Summit, is in its 20th year. The organizers expect 1,200 delegates to attend. While the agenda for this year has not been released yet, the 2022 iteration offered sessions such as:

This event, formerly known as the Inclusive Finance India Summit, is in its 20th year. The organizers expect 1,200 delegates to attend. While the agenda for this year has not been released yet, the 2022 iteration offered sessions such as:

MICROCAPITAL BRIEF: Rite Water of India Nets $8m in Equity from Incofin via Water Access Acceleration Fund

Incofin, a Belgium-based investor in lower-income countries, recently invested EUR 7.5 million (USD 7.8 million) through its Water Access Acceleration Fund (W2AF) in Rite Water Solutions, a company seeking to improve access to clean drinking water in India. Founded in 2006, Rite Water specializes in

Incofin, a Belgium-based investor in lower-income countries, recently invested EUR 7.5 million (USD 7.8 million) through its Water Access Acceleration Fund (W2AF) in Rite Water Solutions, a company seeking to improve access to clean drinking water in India. Founded in 2006, Rite Water specializes in

MICROCAPITAL BRIEF: Abler Nordic Leads $10m Equity, Debt Investment Round for Ergos, Agtech Offering Crop Storage in India

Abler Nordic, a public-private partnership whose investors include the Danish and Norwegian governments, recently led the Series B fundraising round of Indian agricultural technology (agtech) company Ergos, which offers crop storage and a digital platform linking farmers to markets. The funding round comprised

Abler Nordic, a public-private partnership whose investors include the Danish and Norwegian governments, recently led the Series B fundraising round of Indian agricultural technology (agtech) company Ergos, which offers crop storage and a digital platform linking farmers to markets. The funding round comprised

MICROCAPITAL BRIEF: Abler Nordic Sells Equity Stake in Satin Creditcare, Provider of Microfinance to Low-income Women in India

After first investing in the non-banking financial company – microfinance institution (NBFC-MFI) in 2014, the development finance institution Abler Nordic has now exited its investment in Satin Creditcare, a provider of financial services to underrepresented women in India. Among the initial goals of the partnership was to

After first investing in the non-banking financial company – microfinance institution (NBFC-MFI) in 2014, the development finance institution Abler Nordic has now exited its investment in Satin Creditcare, a provider of financial services to underrepresented women in India. Among the initial goals of the partnership was to

MICROCAPITAL BRIEF: HugoBank, KT, Mashreq, Raqami Islamic, Telenor Microfinance Earn Regulatory Approval to Pilot Digital Banking Services in Pakistan

The State Bank of Pakistan (SBP) recently furnished five commercial banks with in-principle approval to set up digital banking platforms. Three of the five – HugoBank, KT Bank Pakistan and Raqami Islamic Digital Bank – have been established this year while the others – Mashreq Bank Pakistan and Telenor Microfinance Bank – have longer track records. These banks can now offer digital financial services on a limited basis, before final rollouts are approved by SBP.

The State Bank of Pakistan (SBP) recently furnished five commercial banks with in-principle approval to set up digital banking platforms. Three of the five – HugoBank, KT Bank Pakistan and Raqami Islamic Digital Bank – have been established this year while the others – Mashreq Bank Pakistan and Telenor Microfinance Bank – have longer track records. These banks can now offer digital financial services on a limited basis, before final rollouts are approved by SBP.

MICROCAPITAL BRIEF: Bababos of Indonesia to Expand Digital Platform for Manufacturing SMEs with $3m in Seed Funding

Bababos, an Indonesian raw material procurement startup, recently raised USD 3 million from Singapore-based East Ventures – the lead investor in the funding round – plus Indonesia-based Patamar Capital and US-based Accion Venture Lab. Bababos helps small and medium-sized enterprises (SMEs) in the

Bababos, an Indonesian raw material procurement startup, recently raised USD 3 million from Singapore-based East Ventures – the lead investor in the funding round – plus Indonesia-based Patamar Capital and US-based Accion Venture Lab. Bababos helps small and medium-sized enterprises (SMEs) in the

MICROFINANCE EVENT: Sa-Dhan National Conference on Inclusive Growth; November 8-9, 2023; New Delhi, India

Sa-Dhan’s 18th annual conference will focus on alleviating poverty through financial inclusion and associated services, including: (1) Microinsurance; (2) Micropensions; (3) Health; (4) Water and Sanitation; (5) Clean Energy and Climate Change; (6) Digitization;

Sa-Dhan’s 18th annual conference will focus on alleviating poverty through financial inclusion and associated services, including: (1) Microinsurance; (2) Micropensions; (3) Health; (4) Water and Sanitation; (5) Clean Energy and Climate Change; (6) Digitization;

MICROCAPITAL BRIEF: Vanuatu Launches Vanklia System to Automate Large, Small Payments

The Reserve Bank of Vanuatu recently launched a digital payment platform called Vanklia that allows automated clearing house (ACH) transfers as well as real-time gross settlements. The ACH system is designed for lower-value batch payments such as salaries and retail payments, while the

The Reserve Bank of Vanuatu recently launched a digital payment platform called Vanklia that allows automated clearing house (ACH) transfers as well as real-time gross settlements. The ACH system is designed for lower-value batch payments such as salaries and retail payments, while the