A seat next to Kwashie Agbitor (pictured below) was one of the most highly sought-after spots at SAM 2023 in Togo in October. Mr Agbitor has 20 years of experience in Africa and Asia, improving branch operations, credit appraisals, risk management, methodology auditing, product development, client protection and social performance management.

A seat next to Kwashie Agbitor (pictured below) was one of the most highly sought-after spots at SAM 2023 in Togo in October. Mr Agbitor has 20 years of experience in Africa and Asia, improving branch operations, credit appraisals, risk management, methodology auditing, product development, client protection and social performance management.

At SAM 2023, Mr Agbitor moderated a discussion titled “Climate funds, an opportunity for financial institutions to scale up sustainable and inclusive financing.” The panelists represented the Tunisian microfinance institution (MFI) Enda Tamweel, the Belgian impact investment firm Incofin, the Kenyan microlender Juhudi Kilimo and the French impact investor Solidarité Internationale pour le Développement et l’Investissement (SIDI).

Bob Summers: How can financial services providers (FSPs) work with climate funds to expand their green lending portfolios?

Kwashie Agbitor: There are numerous opportunities for financial institutions to build their green portfolios with climate funds. Financial institutions can leverage equity, debt and quasi-equity sources of funding from various types of organizations. Climate funds can be used to develop and deploy financial services that support the adoption of green products/solutions and help people recover from climate-related shocks. Given their nature, most climate funders also provide technical support/assistance in addition to funding.

Kwashie Agbitor: There are numerous opportunities for financial institutions to build their green portfolios with climate funds. Financial institutions can leverage equity, debt and quasi-equity sources of funding from various types of organizations. Climate funds can be used to develop and deploy financial services that support the adoption of green products/solutions and help people recover from climate-related shocks. Given their nature, most climate funders also provide technical support/assistance in addition to funding.

BS: What factors influence whether a climate fund would invest in a particular MFI?

KA: Firstly, the MFI and the investor must

The France-based NGO Just Sustainability Transitions (JuST) Institute is holding an online session December 12 to educate potential participants about a mentoring and training program for financial services providers (FSPs) looking to orient their work toward “climate adaptation and biodiversity conservation.” The program, which is for loan officers and managers employed by microfinance institutions (MFIs), takes place online over a period of four to six months. Participation can be part of an MFI becoming certified for

The France-based NGO Just Sustainability Transitions (JuST) Institute is holding an online session December 12 to educate potential participants about a mentoring and training program for financial services providers (FSPs) looking to orient their work toward “climate adaptation and biodiversity conservation.” The program, which is for loan officers and managers employed by microfinance institutions (MFIs), takes place online over a period of four to six months. Participation can be part of an MFI becoming certified for  Andrij Fetsun, Founder & CEO at AFI:

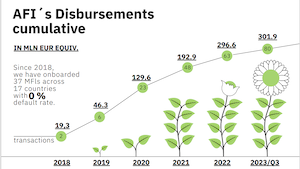

Andrij Fetsun, Founder & CEO at AFI:

Diana Chepng’eno: Sitting within the UN Environment Programme Finance Initiative, under the Principles for Sustainable Insurance, we are ramping up a Sustainable Insurance Facility. We launched the facility in 2022 to advocate for the importance of insurance for micro-, small and medium-sized enterprises (MSMEs) in V20 countries as a significant driver for mitigating climate change risks. MSMEs, for example, comprise about 75 percent of the total GDP of the V20. Therefore, if we can support these MSMEs by facilitating access to much-needed insurance, so that they may become more climate resilient, then these entire countries can be climate-resilient.

Diana Chepng’eno: Sitting within the UN Environment Programme Finance Initiative, under the Principles for Sustainable Insurance, we are ramping up a Sustainable Insurance Facility. We launched the facility in 2022 to advocate for the importance of insurance for micro-, small and medium-sized enterprises (MSMEs) in V20 countries as a significant driver for mitigating climate change risks. MSMEs, for example, comprise about 75 percent of the total GDP of the V20. Therefore, if we can support these MSMEs by facilitating access to much-needed insurance, so that they may become more climate resilient, then these entire countries can be climate-resilient.

The ninth iteration of this event will explore financial services providers’ delivery of digital services to small and medium-sized enterprises (SMEs), leveraging samples from India and abroad. The forum will cover topics – particularly “ecosystems” – relating to digital finance, international

The ninth iteration of this event will explore financial services providers’ delivery of digital services to small and medium-sized enterprises (SMEs), leveraging samples from India and abroad. The forum will cover topics – particularly “ecosystems” – relating to digital finance, international