The African Development Bank (AfDB) recently announced green finance facilities in partnership with the government of Benin’s La Caisse des Dépôts et Consignations du Bénin (CDC) and the government of Côte d’Ivoire’s Banque Nationale d’Investissement (BNI). The aggregate value

The African Development Bank (AfDB) recently announced green finance facilities in partnership with the government of Benin’s La Caisse des Dépôts et Consignations du Bénin (CDC) and the government of Côte d’Ivoire’s Banque Nationale d’Investissement (BNI). The aggregate value

MICROCAPITAL BRIEF: Tunisie Leasing and Factoring Borrows $7.5m from BII-Symbiotics Green Bond Program for SMEs in Tunisia

Symbiotics Investments recently issued a loan of USD 7.5 million to Tunisie Leasing and Factoring (TLF) “to further expand its renewable energy and energy-efficient machinery and equipment offerings” for small and medium-sized enterprises (SMEs) in Tunisia. Symbiotics sourced the funding

Symbiotics Investments recently issued a loan of USD 7.5 million to Tunisie Leasing and Factoring (TLF) “to further expand its renewable energy and energy-efficient machinery and equipment offerings” for small and medium-sized enterprises (SMEs) in Tunisia. Symbiotics sourced the funding

MICROCAPITAL BRIEF: UNCDF, Bill & Melinda Gates Foundation Launch Mobile Money Program in Ethiopia

The UN Capital Development Fund (UNCDF) and the US-based Bill & Melinda Gates Foundation recently announced a two-year cash-in/cash-out (CICO) program intended to increase financial inclusion in Ethiopia via mobile money agents and other means. The program is to include: (1) training for 15 service providers in “digital money distribution aspects such as gender-intentional design and technology provider selection;” (2) a Digital

The UN Capital Development Fund (UNCDF) and the US-based Bill & Melinda Gates Foundation recently announced a two-year cash-in/cash-out (CICO) program intended to increase financial inclusion in Ethiopia via mobile money agents and other means. The program is to include: (1) training for 15 service providers in “digital money distribution aspects such as gender-intentional design and technology provider selection;” (2) a Digital

MICROFINANCE EVENT: Sankalp West Africa Summit; June 12-13, 2023; Accra, Ghana

This event will focus on mechanisms through which entrepreneurial partnerships in regions such as South Asia, Southeast Asia and Africa, can solve global issues. The organizers expect approximately 80 speakers and 300 delegates discussing topics such as: (1) Agriculture; (2) Climate Change and Clean Energy;

This event will focus on mechanisms through which entrepreneurial partnerships in regions such as South Asia, Southeast Asia and Africa, can solve global issues. The organizers expect approximately 80 speakers and 300 delegates discussing topics such as: (1) Agriculture; (2) Climate Change and Clean Energy;

MICROCAPITAL BRIEF: Araratbank of Armenia, FMO Ink $10m Risk-sharing Facility to Boost MSMEs

The Armenian bank Araratbank and Dutch development bank Financierings-Maatschappij voor Ontwikkelingslanden (FMO) recently agreed to expand their risk-sharing facility by USD 10 million. FMO’s portion of the commitment is from its Nasira Fund, which guarantees

The Armenian bank Araratbank and Dutch development bank Financierings-Maatschappij voor Ontwikkelingslanden (FMO) recently agreed to expand their risk-sharing facility by USD 10 million. FMO’s portion of the commitment is from its Nasira Fund, which guarantees

MICROFINANCE EVENT: Enlit Africa Forum on Energy, Power and Water; May 16-18, 2023; Cape Town, South Africa

The 2023 edition of this annual event will cover topics relating to energy and water in Africa, including how to invest in support of climate resilience and energy security while aligning short-term successes with host nations’ long-term visions. The opening-day keynote is titled

The 2023 edition of this annual event will cover topics relating to energy and water in Africa, including how to invest in support of climate resilience and energy security while aligning short-term successes with host nations’ long-term visions. The opening-day keynote is titled

MICROCAPITAL BRIEF: DFIs Invest $109m in Horizon Capital IV to Support SMEs in Ukraine, Moldova

Six public-sector organizations recently invested in the second funding round of Horizon Capital IV with the goal of enabling the equity fund to supply more working capital to “fast-growing, technology-enabled small and medium-size businesses” in Ukraine and Moldova. The fund also seeks to

Six public-sector organizations recently invested in the second funding round of Horizon Capital IV with the goal of enabling the equity fund to supply more working capital to “fast-growing, technology-enabled small and medium-size businesses” in Ukraine and Moldova. The fund also seeks to

MICROCAPITAL BRIEF: AFI Invests $5m in Microfinance Institution AFK of Kosovo from Invest in Visions (IIV)

The Germany-based investing company Agents for Impact (AFI) recently informed MicroCapital that it has issued a loan of USD 5 million to

The Germany-based investing company Agents for Impact (AFI) recently informed MicroCapital that it has issued a loan of USD 5 million to

SPECIAL REPORT: Small Is Beautiful – Sustainable Agriculture Finance

What financial institutions can do to help poor smallholder farmers secure their livelihoods and make their communities more climate-resilient

Big in numbers, small in size

When German-born British economist E F Schumacher published his book Small Is Beautiful in 1973, he proposed an alternative to the mainstream economic principle of “bigger is better.” Mr Schumacher was an early proponent of sustainable development, demanding that people and planet should matter more than mere profits.

Agriculture plays a key role in global and local sustainable development. It is not an exaggeration to say: Farming is everyone’s business! Just think about the following mind-blowing facts:

- The world population will reach 10 billion by the year 2050, and global food demand will increase by some 50 percent by then.

- 30 percent of global food production is wasted after harvest.

- Every year, we lose almost 1 percent of global farmland due to environmental degradation.

- 26 percent of global greenhouse gas emissions, which cause climate change, come from the food sector.

- Up to 2,000 species of wild animals and plants are estimated to become extinct each year, and agriculture is a main driver of this biodiversity loss.

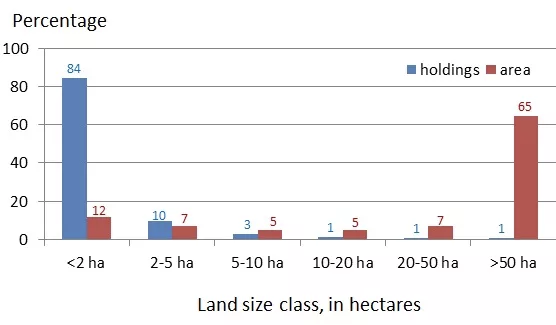

- There are an estimated 570 million farms worldwide, 84 percent of which are smallholdings with less than 2 hectares of land (equivalent to a plot of 200 meters by 100 meters).

- Smallholder farms comprise only 12 percent of all agricultural land on our planet, but still produce roughly one third of the world’s food.

Distribution of the world’s farms and farmland area by land size class.

Source: CGAP.

Why do smallholder farmers matter?

To consider sustainability in all its

MICROCAPITAL BRIEF: Enabling Qapital Loans $10m to AccessBank for Microfinance, SME Lending in Azerbaijan

Enabling Qapital Limited, a Switzerland-based investment advisory company, recently issued a loan of AZN 17 million (USD 10 million) to AccessBank, which was founded in 2002 to provide credit and other financial services to smaller businesses and low-income families in Azerbaijan. The three-year loan is to be used

Enabling Qapital Limited, a Switzerland-based investment advisory company, recently issued a loan of AZN 17 million (USD 10 million) to AccessBank, which was founded in 2002 to provide credit and other financial services to smaller businesses and low-income families in Azerbaijan. The three-year loan is to be used

MICROFINANCE EVENT: Asia Pacific Microfinance Forum; October 17-18, 2023; Kuala Lumpur, Malaysia

This event, in its fourth edition, aims to facilitate networking among investors and retail financial institutions. With a focus on market trends, the forum will address topics such as: (1) Recent Developments in Responsible Inclusive Finance; (2) Strategies to Overcome

This event, in its fourth edition, aims to facilitate networking among investors and retail financial institutions. With a focus on market trends, the forum will address topics such as: (1) Recent Developments in Responsible Inclusive Finance; (2) Strategies to Overcome

MICROCAPITAL BRIEF: UN, EU Supporting SMEs Involved in Fisheries in Cambodia via Capfish-Capture Program

Capfish-Capture, a project organized by the UN Industrial Development Organization (UNIDO), is giving technical and financial support to small and medium-sized enterprises (SMEs) in Cambodia’s fishing industry to promote compliance with international food safety standards, allow SMEs to upgrade their machinery, connect SMEs with microfinance and venture capital, and increase academic research into post-harvest food technology. As of 2023, 28

Capfish-Capture, a project organized by the UN Industrial Development Organization (UNIDO), is giving technical and financial support to small and medium-sized enterprises (SMEs) in Cambodia’s fishing industry to promote compliance with international food safety standards, allow SMEs to upgrade their machinery, connect SMEs with microfinance and venture capital, and increase academic research into post-harvest food technology. As of 2023, 28

MICROCAPITAL BRIEF: Visa Everywhere Initiative 2023 Offering $500k for Fintech Innovation

US-based payment technology firm Visa and TechCrunch, a media company owned by US-based technology firm Yahoo, recently opened the Visa Everywhere Initiative 2023, a contest offering USD 500,000 in prizes to financial technology firms (fintechs) that “deliver innovative payment and commerce solutions.” Applicants apply based

US-based payment technology firm Visa and TechCrunch, a media company owned by US-based technology firm Yahoo, recently opened the Visa Everywhere Initiative 2023, a contest offering USD 500,000 in prizes to financial technology firms (fintechs) that “deliver innovative payment and commerce solutions.” Applicants apply based

MICROCAPITAL BRIEF: Agents for Impact Disburses $8m from Invest in Visions (IIV) to Microfinance Institutions Digamber of India, Imon of Tajikistan

Agents for Impact (AFI), a Germany-based investing company, recently informed MicroCapital that it has disbursed a loan of EUR 5 million (USD 5.5 million) to Digamber Capfin Limited, a microfinance institution (MFI) serving rural women in India, on behalf of Invest in Visions (IIV). AFI also

Agents for Impact (AFI), a Germany-based investing company, recently informed MicroCapital that it has disbursed a loan of EUR 5 million (USD 5.5 million) to Digamber Capfin Limited, a microfinance institution (MFI) serving rural women in India, on behalf of Invest in Visions (IIV). AFI also

MICROCAPITAL BRIEF: Arnur Credit of Kazakhstan Borrows $3.3m from Grameen Crédit Agricole to Expand Access to Microfinance

The Luxembourg-based Grameen Crédit Agricole (GCA) Foundation recently loaned EUR 3 million (USD 3.3 million) to Arnur Credit, a microfinance institution (MFI) that operates in southern Kazakhstan. Arnur provides

The Luxembourg-based Grameen Crédit Agricole (GCA) Foundation recently loaned EUR 3 million (USD 3.3 million) to Arnur Credit, a microfinance institution (MFI) that operates in southern Kazakhstan. Arnur provides

MICROCAPITAL BRIEF: Luxembourg Invests $25m in First Close of Green Earth Impact Fund, Managed by BlueOrchard, Schroders

The Luxembourg Ministry of Finance, the UK-based Schroders Group and its Switzerland-based unit BlueOrchard Finance recently announced the first closing of the Green Impact Earth Fund (GEIF) with a USD 25 million commitment from the Ministry of Finance. The fund

The Luxembourg Ministry of Finance, the UK-based Schroders Group and its Switzerland-based unit BlueOrchard Finance recently announced the first closing of the Green Impact Earth Fund (GEIF) with a USD 25 million commitment from the Ministry of Finance. The fund

MICROFINANCE EVENT: Global Forum on Remittances, Investment and Development (GFRID); June 14-16, 2023; Nairobi, Kenya

The eighth edition of this biennial event will begin with two days of sessions with titles such as: (1) Remittances and Diaspora Investment as Tools for

The eighth edition of this biennial event will begin with two days of sessions with titles such as: (1) Remittances and Diaspora Investment as Tools for

MICROFINANCE EVENT: Responsible Finance Forum; July 5-7, 3023; Bengaluru, India

Themed “Shaping a Responsible Digital Finance Ecosystem,” the upcoming edition of this event – the first in-person since 2019 – will focus on client protection to help “low-income and vulnerable” people reduce risks as they use financial tools. Although the detailed agenda has not yet been finalized, it is expected to include topics such as: (1) Balancing Responsible Finance Between

Themed “Shaping a Responsible Digital Finance Ecosystem,” the upcoming edition of this event – the first in-person since 2019 – will focus on client protection to help “low-income and vulnerable” people reduce risks as they use financial tools. Although the detailed agenda has not yet been finalized, it is expected to include topics such as: (1) Balancing Responsible Finance Between