What financial institutions can do to help poor smallholder farmers secure their livelihoods and make their communities more climate-resilient

Big in numbers, small in size

When German-born British economist E F Schumacher published his book Small Is Beautiful in 1973, he proposed an alternative to the mainstream economic principle of “bigger is better.” Mr Schumacher was an early proponent of sustainable development, demanding that people and planet should matter more than mere profits.

Agriculture plays a key role in global and local sustainable development. It is not an exaggeration to say: Farming is everyone’s business! Just think about the following mind-blowing facts:

- The world population will reach 10 billion by the year 2050, and global food demand will increase by some 50 percent by then.

- 30 percent of global food production is wasted after harvest.

- Every year, we lose almost 1 percent of global farmland due to environmental degradation.

- 26 percent of global greenhouse gas emissions, which cause climate change, come from the food sector.

- Up to 2,000 species of wild animals and plants are estimated to become extinct each year, and agriculture is a main driver of this biodiversity loss.

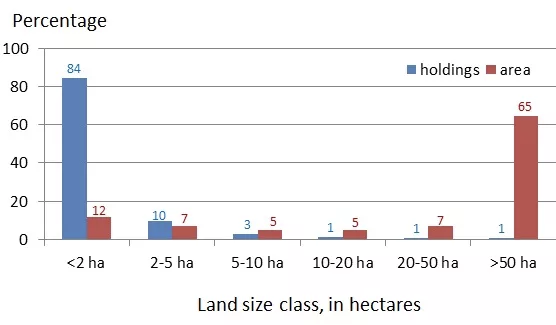

- There are an estimated 570 million farms worldwide, 84 percent of which are smallholdings with less than 2 hectares of land (equivalent to a plot of 200 meters by 100 meters).

- Smallholder farms comprise only 12 percent of all agricultural land on our planet, but still produce roughly one third of the world’s food.

Distribution of the world’s farms and farmland area by land size class.

Source: CGAP.

Why do smallholder farmers matter?

To consider sustainability in all its dimensions – social, economic and environmental – we need to focus on the world’s half billion smallholder farms.

About two thirds of the world’s poor are farmers. The good news first: Growth in the agricultural sector is two to four times more effective in raising incomes among the poorest, compared to other sectors. The bad news: Only a quarter of the estimated USD 200 billion of farmers’ financing needs currently are being met by the financial sector. Put more positively: providing finance to smallholders is the biggest opportunity for scale and impact in financial inclusion today.

Most smallholder farmers are poor and suffer seasonal food shortages. Already insecure, these livelihoods face increasing threats from the effects of climate change, degraded ecosystems, pollution and depletion of natural resources: Think of droughts, floods, storms, farmland turning into deserts, water polluted by agrochemicals; on top of that, armed conflicts, land grabbing and forced displacements of farmers who have no official land ownership titles. There are countless threats to smallholders’ livelihoods, most of which can be tackled by shifting to sustainable farming methods.

The typical smallholder farm is managed in a traditional way: mixed farming to produce food for the family and sell any surplus on the local market. Even where smallholders cultivate cash crops, like coffee or cotton, they use less agrochemicals than larger farms. With the help of simple investments, these small farms can be made more productive and at the same time more environmentally sustainable. For example, trees planted on farms as part of an agroforestry system generate additional income for the farmer, while making the farm more climate-resilient (via protection from heat and storms), capturing carbon (in the timber and soil) and fostering biodiversity (by creating habitats for insects and birds). There are many such simple sustainable farming methods that can have positive social, economic and environmental impacts at the same time.

Financial institutions can make a difference

Why are smallholder farmers not putting all these great ideas into practice? Simple answer: They lack the funds. This is where financial institutions come into play.

The main reasons why most banks and insurers shy away from serving smallholders are the perceived risks of agriculture and the relatively high transaction costs of serving farmers in remote areas. Fortunately, there are answers to these problems.

Successful providers of smallholder finance, such as rural microfinance institutions and agricultural development banks, have found ways to tackle the risk and cost challenges. For example, they cooperate with farmer groups, cooperatives, exporters and food processors to channel loans and repayments through their books. Funds are invested for sustainable farming practices, including agroforestry, certified organic farming, the production of biofuels, or rainwater harvesting and drip irrigation, to just name a few examples.

Insurance companies have successfully experimented with index insurance to cover farmers against droughts and other risks. And there are many innovations in the field of digital finance, such as the use of mobile phones to transfer payments from buyers to farmers and to distribute technical farming advice via text messages.

Frankfurt School Summer Academy

Employees of financial institutions require new technical and managerial skills to tackle the various challenges related to the ongoing transformation of agriculture. This is one of the focus areas of the Inclusive Finance Summer Academy 2023 offered by the Frankfurt School of Finance & Management from 3 to 7 July 2023 in Frankfurt am Main, Germany. Other themes of this year’s Summer Academy are Risk Management, Digital and Inclusive Finance, Sustainable Finance, and Strategic Bank Management.

For more information, visit: https://www.fs.de/summeracademy.

This feature is written by By Helmut Grossmann, Senior Advisor and Training Expert at Frankfurt School of Finance & Management, which is the sponsor of this feature.

Similar Posts:

- SPECIAL REPORT: Leveraging Financial Inclusion to Get Food Security Back on the Increase #EMW2023

- SPECIAL REPORT: The Impact of Digital Financial Inclusion on Global Development

- MICROCAPITAL BRIEF: EIB Lending $22m to Sahanala to Boost Sustainable Fisheries, Agricultural Value Chains, Mechanization of Farms in Madagascar

- SPECIAL REPORT: Inclusive Finance in Africa Amid the Current Food and Climate Crises, in Anticipation of SAM 2023 in West Africa

- SPECIAL REPORT: Fortune Credit of Kenya, Fundación Génesis Empresarial of Guatemala, Yikri of Burkina Faso Are Finalists for European Microfinance Award 2023 on Inclusive Finance for Food Security & Nutrition