Opportunity EduFinance, an affiliate of the US-based NGO Opportunity International, recently brought on seven new financial services provider (FSP) partners, with whom it plans to invest in affordable private education in India, Nigeria and Rwanda. Although the FSPs have not been identified publicly, they are expected to

Opportunity EduFinance, an affiliate of the US-based NGO Opportunity International, recently brought on seven new financial services provider (FSP) partners, with whom it plans to invest in affordable private education in India, Nigeria and Rwanda. Although the FSPs have not been identified publicly, they are expected to

Category: Education

SPECIAL REPORT: The Business Case for Education Finance #EMW2023

Many families in low- and middle-income countries send their kids to low-cost private schools because the government is not meeting the need. However, many of these schools are not registered as businesses and don’t keep good records, so it is hard for them to borrow from banks to improve their facilities. Meanwhile, about one in five school-aged children – 260 million worldwide – are not in school.

Many families in low- and middle-income countries send their kids to low-cost private schools because the government is not meeting the need. However, many of these schools are not registered as businesses and don’t keep good records, so it is hard for them to borrow from banks to improve their facilities. Meanwhile, about one in five school-aged children – 260 million worldwide – are not in school.

Varthana is a lender in India that specializes helping schools expand. Its loans are often in the range of USD 20,000 to USD 100,000. The firm has developed a track record and so now is able to

MICROCAPITAL BRIEF: Aflatoun, Fintech Robos to Collaborate on Financial Literacy in Middle East, North Africa

The Dutch NGO Aflatoun International and Bahrain-based financial advisory firm Fintech Robos recently agreed to collaborate on their efforts to expand financial literacy in the Middle East and North Africa (MENA). The partners plan to promote financial education through the development of “curriculum and training materials”

The Dutch NGO Aflatoun International and Bahrain-based financial advisory firm Fintech Robos recently agreed to collaborate on their efforts to expand financial literacy in the Middle East and North Africa (MENA). The partners plan to promote financial education through the development of “curriculum and training materials”

MICROCAPITAL BRIEF: DAI’s MicroVest Loans $4m to Bayport Colombia, Payroll Lender to Public Sector Workers

US-based MicroVest, a unit of Development Alternatives Incorporated (DAI), recently lent USD 4 million to Bayport Colombia, a financial services provider seeking to “expand credit accessibility and financial empowerment” among public sector employees. This transaction marks MicroVest’s third investment in Bayport since 2016.

US-based MicroVest, a unit of Development Alternatives Incorporated (DAI), recently lent USD 4 million to Bayport Colombia, a financial services provider seeking to “expand credit accessibility and financial empowerment” among public sector employees. This transaction marks MicroVest’s third investment in Bayport since 2016.

Established in 2007, Bayport Colombia lends to employees

MICROCAPITAL BRIEF: Joliba Capital Raises $58m in Equity from FMO, IFC, Proparco to Support SMEs, Mid-caps in Central, West Africa

Joliba Capital of Côte d’Ivoire recently raised EUR 55 million (USD 57.8 million) for its newly launched Joliba Capital Fund. The participants in this first close of the fund are the Dutch development bank Financierings-Maatschappij voor Ontwikkelingslanden (FMO); the International Finance Corporation (IFC),

Joliba Capital of Côte d’Ivoire recently raised EUR 55 million (USD 57.8 million) for its newly launched Joliba Capital Fund. The participants in this first close of the fund are the Dutch development bank Financierings-Maatschappij voor Ontwikkelingslanden (FMO); the International Finance Corporation (IFC),

MICROFINANCE EVENT: Social Enterprise World Forum (SEWF23); October 11-12, 2023; Amsterdam, the Netherlands

The goal of this event is to champion the use of social enterprise as a catalyst for positive change worldwide. The topics to be discussed include: (1) The Role of Corporates in Social Enterprise Partnerships; and (2) Migration: Entrepreneurial Solutions for Better Lives and Livelihoods.

The goal of this event is to champion the use of social enterprise as a catalyst for positive change worldwide. The topics to be discussed include: (1) The Role of Corporates in Social Enterprise Partnerships; and (2) Migration: Entrepreneurial Solutions for Better Lives and Livelihoods.

MICROFINANCE EVENT: International Social Innovation Research Conference (ISIRC); September 6-9, 2023; Guimarães, Portugal

The goal of the 15th International Social Innovation Research Conference (ISIRC) is “bringing together the social sciences, engineering and technology” to leverage “social innovation and social entrepreneurship” to address global problems. The 17 streams address areas such as health, education,

The goal of the 15th International Social Innovation Research Conference (ISIRC) is “bringing together the social sciences, engineering and technology” to leverage “social innovation and social entrepreneurship” to address global problems. The 17 streams address areas such as health, education,

MICROFINANCE PAPER WRAP-UP: “Driving Digital Financial Services in Africa Through Merchant Acceptance of Digital Payments,” published by Alliance for Financial Inclusion (AFI)

This paper examines the growth and challenges of digital payment adoption by retailers in Africa, including “contactless payment (QR codes, tap to pay) [and] buy-now-pay-later” services. The authors note four main prerequisites for merchant adoption:

This paper examines the growth and challenges of digital payment adoption by retailers in Africa, including “contactless payment (QR codes, tap to pay) [and] buy-now-pay-later” services. The authors note four main prerequisites for merchant adoption:

MICROCAPITAL BRIEF: Kashf Foundation of Pakistan Borrows in Local Currency from SEB Microfinance Funds, Arranged by Symbiotics

Kashf Foundation, a provider of microloans and microinsurance to women in Pakistan, recently secured a local-currency loan of undisclosed size from SEB Microfinance Funds, an offering of

Kashf Foundation, a provider of microloans and microinsurance to women in Pakistan, recently secured a local-currency loan of undisclosed size from SEB Microfinance Funds, an offering of

MICROCAPITAL BRIEF: Seedstars Accepting Applications from Fintechs Offering “Financial Innovations for Women Affected by Migration” Through July 30

Seedstars, a Switzerland-based investment and education firm, is accepting applications from financial technology (fintech) startups looking to scale up their services to women in Africa and Asia who have migrated from their homes or whose family members have done so. Seedstars is offering this support through its Financial Innovations for Women Affected by Migration (FIWAM) programme, which includes

Seedstars, a Switzerland-based investment and education firm, is accepting applications from financial technology (fintech) startups looking to scale up their services to women in Africa and Asia who have migrated from their homes or whose family members have done so. Seedstars is offering this support through its Financial Innovations for Women Affected by Migration (FIWAM) programme, which includes

MICROCAPITAL BRIEF: 24 Education Technology Startups in Kenya, Nigeria Joining Mastercard Foundation EdTech Fellowship

The Canada-based Mastercard Foundation recently announced that 24 educational technology (edtech) startups in Kenya and Nigeria have joined the Mastercard Foundation EdTech Fellowship program, which promotes “technology in learning and teaching to benefit learners, education and edtech innovators across the continent” of Africa. The Kenyan inductees are listed at:

The Canada-based Mastercard Foundation recently announced that 24 educational technology (edtech) startups in Kenya and Nigeria have joined the Mastercard Foundation EdTech Fellowship program, which promotes “technology in learning and teaching to benefit learners, education and edtech innovators across the continent” of Africa. The Kenyan inductees are listed at:

MICROFINANCE PAPER WRAP-UP: “Determinants of Choice of Credit Source Among Clients of Microfinance Systems in the Upper West Region of Ghana,” by Paul Bata Domanban et al

The authors of this article examined which groups of people in northwestern Ghana were more and less likely to borrow money from microfinance institutions (MFIs). The authors conducted

The authors of this article examined which groups of people in northwestern Ghana were more and less likely to borrow money from microfinance institutions (MFIs). The authors conducted

MICROFINANCE PAPER WRAP-UP: “Mind the Gap in Financial Inclusion! Microcredit Institutions Fieldwork in Peru;” by Pilar Lopez-Sancheza, Elena Urquia-Grande

Microfinance providers in Peru carry a combined outstanding loan portfolio equivalent to USD 12.7 billion, serving 5 million borrowers. Dr Lopez-Sancheza and Dr Urquia-Grande conducted a qualitative analysis of these loans based on

Microfinance providers in Peru carry a combined outstanding loan portfolio equivalent to USD 12.7 billion, serving 5 million borrowers. Dr Lopez-Sancheza and Dr Urquia-Grande conducted a qualitative analysis of these loans based on

MICROCAPITAL BRIEF: Futu Expanding Digital Investment, Financial Education Platform to Malaysia

The Hong Kong-based wealth management company Futu Holdings is adding Malaysia to the list of countries whose residents can access its investment platform Moomoo, following the firm’s local subsidiary receiving preliminary regulatory approval for the service. Moomoo allows

The Hong Kong-based wealth management company Futu Holdings is adding Malaysia to the list of countries whose residents can access its investment platform Moomoo, following the firm’s local subsidiary receiving preliminary regulatory approval for the service. Moomoo allows

MICROFINANCE PAPER WRAP-UP: “Impact of Microcredit on Household Consumption and Assets in Nepal;” by Shalik Ram Pokhrel

Dr Pokhrel hypothesized that microcredit is a sustainable tool for poverty reduction, based on the idea that access to microcredit can improve household income and employment opportunities, thus leading to increases in household consumption and asset ownership. The study employed data from

Dr Pokhrel hypothesized that microcredit is a sustainable tool for poverty reduction, based on the idea that access to microcredit can improve household income and employment opportunities, thus leading to increases in household consumption and asset ownership. The study employed data from

MICROCAPITAL BRIEF: G20, SME Finance Forum Showcase Digital Finance Solutions for MSMEs Via Online Database, Seek Submissions

The Group of Twenty (G20), an association of the world’s larger economies, recently released a digital database hosting descriptions of “innovative financial products and services” – other than lending – that are available to micro-, small and medium-sized enterprises (MSMEs) across the globe. The entries are classified as offering Cash Management, Credit Guarantees

The Group of Twenty (G20), an association of the world’s larger economies, recently released a digital database hosting descriptions of “innovative financial products and services” – other than lending – that are available to micro-, small and medium-sized enterprises (MSMEs) across the globe. The entries are classified as offering Cash Management, Credit Guarantees

MICROCAPITAL BRIEF: UNCDF, Bill & Melinda Gates Foundation Launch Mobile Money Program in Ethiopia

The UN Capital Development Fund (UNCDF) and the US-based Bill & Melinda Gates Foundation recently announced a two-year cash-in/cash-out (CICO) program intended to increase financial inclusion in Ethiopia via mobile money agents and other means. The program is to include: (1) training for 15 service providers in “digital money distribution aspects such as gender-intentional design and technology provider selection;” (2) a Digital

The UN Capital Development Fund (UNCDF) and the US-based Bill & Melinda Gates Foundation recently announced a two-year cash-in/cash-out (CICO) program intended to increase financial inclusion in Ethiopia via mobile money agents and other means. The program is to include: (1) training for 15 service providers in “digital money distribution aspects such as gender-intentional design and technology provider selection;” (2) a Digital

SPECIAL REPORT: Small Is Beautiful – Sustainable Agriculture Finance

What financial institutions can do to help poor smallholder farmers secure their livelihoods and make their communities more climate-resilient

Big in numbers, small in size

When German-born British economist E F Schumacher published his book Small Is Beautiful in 1973, he proposed an alternative to the mainstream economic principle of “bigger is better.” Mr Schumacher was an early proponent of sustainable development, demanding that people and planet should matter more than mere profits.

Agriculture plays a key role in global and local sustainable development. It is not an exaggeration to say: Farming is everyone’s business! Just think about the following mind-blowing facts:

- The world population will reach 10 billion by the year 2050, and global food demand will increase by some 50 percent by then.

- 30 percent of global food production is wasted after harvest.

- Every year, we lose almost 1 percent of global farmland due to environmental degradation.

- 26 percent of global greenhouse gas emissions, which cause climate change, come from the food sector.

- Up to 2,000 species of wild animals and plants are estimated to become extinct each year, and agriculture is a main driver of this biodiversity loss.

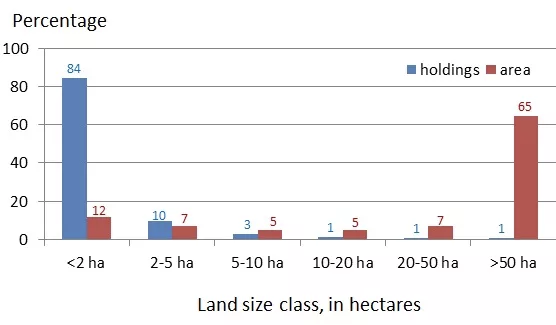

- There are an estimated 570 million farms worldwide, 84 percent of which are smallholdings with less than 2 hectares of land (equivalent to a plot of 200 meters by 100 meters).

- Smallholder farms comprise only 12 percent of all agricultural land on our planet, but still produce roughly one third of the world’s food.

Distribution of the world’s farms and farmland area by land size class.

Source: CGAP.

Why do smallholder farmers matter?

To consider sustainability in all its