This is part of a series of features sponsored by Agents for Impact (AFI), a German impact investing firm whose products include the AFI Sustainability Alignment Rating (AFISAR©) tool. AFISAR© is a trust mark – in microfinance and other forms of social business – signifying a commitment to positive and enduring change for people and the planet, based on the UN Sustainable Development Goal (SDG) framework.

This is part of a series of features sponsored by Agents for Impact (AFI), a German impact investing firm whose products include the AFI Sustainability Alignment Rating (AFISAR©) tool. AFISAR© is a trust mark – in microfinance and other forms of social business – signifying a commitment to positive and enduring change for people and the planet, based on the UN Sustainable Development Goal (SDG) framework.

AFISAR© helps MFIs leverage the market’s growing focus on sustainability performance to raise capital from international investors and, particularly, impact investors. The rating helps investors and social businesses understand their strengths and weaknesses and devise effective strategies to minimize negative impact and maximize positive impact to the benefit of the organization – its employees, clients and other stakeholders – as well as the environment.

The conversation below outlines the AFISAR© rating process carried out in the “direct partnership” format by a leading MFI like Svasti Microfinance. Direct partnership offers a continuous and immersive experience to facilitate sustainable transitions. The active dialogue and engagement embedded in the AFISAR© process enable the MFI as well as asset managers to embark on a journey that leads to long-term sustainable development. AFI highly values long-term partnerships with organizations sharing our mission of achieving the UN SDGs. We take this so seriously that a rating above the sustainability threshold is required for the disbursement funds.

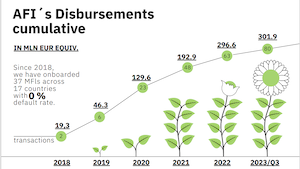

To date, AFI has used AFISAR© to rate 35+ microfinance and SME finance institutions in Asia, East Africa and Eastern Europe, helping the institutions demonstrate their SDG competency and alignment.

Pratibha Singh (pictured): How did you become interested in microfinance?

Pratibha Singh (pictured): How did you become interested in microfinance?

Arunkumar Padmanabhan: I was a lawyer and had worked for some years with ICICI Bank. Based on that experience, I wanted to set up a commercial business in the social impact space. We started in the slums of Mumbai, and now we have expanded to eight states in India with 220,000 borrowers across 120 branches.

PS: What makes the Svasti model unique?

AP: The key to success in this field is based on three aspects: people, process and technology. Our vision follows the “people-first” approach. Technology and innovation are driving forces as well, and we have built all of our systems from the ground up. That gives us a significant competitive advantage. Meanwhile, we have focussed on client protection and social impact from a very early stage in our development. With AFISAR©, we have become one of the few companies that is measuring its performance based on the SDGs. Constantly trying to improve in impact-driven areas is of great strategic importance.

PS: What is at stake for

Andrij Fetsun, Founder & CEO at AFI:

Andrij Fetsun, Founder & CEO at AFI: As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

Agents for Impact (AFI), a Germany-based investing company, recently informed MicroCapital that it has disbursed a loan of EUR 5 million (USD 5.5 million) to Digamber Capfin Limited, a microfinance institution (MFI) serving rural women in India, on behalf of Invest in Visions (IIV). AFI also

Agents for Impact (AFI), a Germany-based investing company, recently informed MicroCapital that it has disbursed a loan of EUR 5 million (USD 5.5 million) to Digamber Capfin Limited, a microfinance institution (MFI) serving rural women in India, on behalf of Invest in Visions (IIV). AFI also

are pleased to have an experienced investor at our side that will carry Agents for Impact into the future and enable us to expand our business,” says Dr Andrij Fetsun, AFI’s CEO (pictured).

are pleased to have an experienced investor at our side that will carry Agents for Impact into the future and enable us to expand our business,” says Dr Andrij Fetsun, AFI’s CEO (pictured). How best to invest in Africa? What makes this region attractive to investors? This month, we introduce you to Joy Ogutu (pictured), an Africa-based Investment Officer at

How best to invest in Africa? What makes this region attractive to investors? This month, we introduce you to Joy Ogutu (pictured), an Africa-based Investment Officer at

Pratibha Singh (pictured): How did you become interested in microfinance?

Pratibha Singh (pictured): How did you become interested in microfinance?