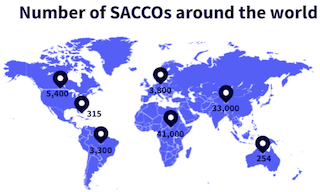

According to the World Council of Credit Unions (WOCCU), a credit union is “a customer/member-owned financial cooperative, democratically controlled by its members, and operated to maximize the economic benefit of its members by providing financial services at competitive and fair rates.” In short, savings and credit cooperatives (SACCOs) are member-based institutions that intermediate savings into loans, enabling low-income populations to accumulate savings and create a source of credit at reasonable rates. Cooperatives represent an economically viable avenue for changing people’s lives, based on the powerful idea that cooperation allows goals to be achieved and the lives of communities to be transformed. Nowadays, credit unions are operating in most countries around the world, and their number is continuously increasing. The latest Statistical Report from WOCCU states that in 2021 there were over 87,000 credit unions in 118 countries improving the lives and communities of 393 million members. The infographic below shows the number of SACCOs in seven regions of the world.

According to the World Council of Credit Unions (WOCCU), a credit union is “a customer/member-owned financial cooperative, democratically controlled by its members, and operated to maximize the economic benefit of its members by providing financial services at competitive and fair rates.” In short, savings and credit cooperatives (SACCOs) are member-based institutions that intermediate savings into loans, enabling low-income populations to accumulate savings and create a source of credit at reasonable rates. Cooperatives represent an economically viable avenue for changing people’s lives, based on the powerful idea that cooperation allows goals to be achieved and the lives of communities to be transformed. Nowadays, credit unions are operating in most countries around the world, and their number is continuously increasing. The latest Statistical Report from WOCCU states that in 2021 there were over 87,000 credit unions in 118 countries improving the lives and communities of 393 million members. The infographic below shows the number of SACCOs in seven regions of the world.

SACCOs address the needs of poor populations

SACCOs play an active role in both rural and urban areas. The growth over the last 10 years, both in the number of cooperatives and the number of their members, indicates that financial cooperatives are successfully supporting people in undertaking activities that contribute to their economic development. The services cooperatives provide to their members help them start new businesses or expand existing ones, improve the productivity of farms and microenterprises, and boost human and social capital. For example, cooperatives foster resource mobilization, processing and marketing in support of agricultural production. The cooperative movement also plays an important role in wealth creation, food security, and the generation of employment to offset vulnerabilities and reduce poverty.

An opportunity to overcome SACCOs’ challenges

Despite these successes, SACCOs must address a diversity of challenges to keep generating impact on the populations they serve. One of these is the weak institutional capacity with which many of them struggle – both in terms of management capacity and governance. Another obstacle is reporting and data management – both for internal operations and for keeping stakeholders informed. SACCO managers and leadership need access to reports that are tailored to their needs: high-level, well-summarized and universal reports that make it easy understand a cooperative’s financial situation.

financial services in rural and suburban Senegal.

Strengthening SACCOs through high-quality training and free tools

Microfact, a flagship project of BRS, is designed to serve SACCOs by providing tools, training, technical assistance and other resources for strengthening their performance. In this way, Microfact expands financial inclusion by offering credit unions and all other types of financial services providers (FSPs) – as well as their stakeholders – the best e?learning courses, technical assistance, and reporting and management tools for building business plans and creating financial projections. By engaging in high-quality training through Microfact, SACCOs can easily upgrade the capacities of their personnel. Microfact’s free tools enable SACCOs to use data to their advantage with automated reporting that eases compliance with international standards. Being able to prepare financial and social projections – and quickly update them to anticipate the impact of various events and adjust strategy accordingly – makes SACCOs far more resilient.

Microfact – Let your figures talk!

Comprehensive and universal reporting dashboards available within Microfact’s MFI Factsheet and Microvision tools offer a common language for all types of stakeholders who want to have better insight into the financial and social performance of  FSPs. Please contact the Microfact team for more guidance and details on building the capacity of SACCOs with a specially designed programme: Microfact Alliance for Impact.

FSPs. Please contact the Microfact team for more guidance and details on building the capacity of SACCOs with a specially designed programme: Microfact Alliance for Impact.

This feature was written by Jarek Chuchla and Yoselin Galo (pictured), and it is sponsored by Microfact.

Similar Posts:

- MICROCAPITAL BRIEF: Kwara of Kenya Raises $3m in Equity to Boost Technology for SACCOs, Acquires KUSCCO Software Subsidiary

- SPECIAL REPORT: Inclusivity in Capital Markets Demands Sustainability Reporting

- MICROFINANCE EVENT: Global Impact Investing Network (GIIN) Impact Forum; October 4-5, 2023; Copenhagen, Denmark

- MICROFINANCE PAPER WRAP-UP: “2023 Microfinance Index Report,” Published by 60 Decibels

- MICROFINANCE EVENT: Social Enterprise World Forum (SEWF23); October 11-12, 2023; Amsterdam, the Netherlands