In 2018, e-MFP launched the first Financial Inclusion Compass, a new annual publication series to collate sector opinions on emerging short-, medium- and long-term trends in the financial inclusion sector. e-MFP is delighted to now publish the English language version of the Financial Inclusion Compass 2021 – the fourth in the series.

2018, e-MFP launched the first Financial Inclusion Compass, a new annual publication series to collate sector opinions on emerging short-, medium- and long-term trends in the financial inclusion sector. e-MFP is delighted to now publish the English language version of the Financial Inclusion Compass 2021 – the fourth in the series.

The survey on which this paper is based was open in May 2021, with financial services providers (FSPs), investors, donors, researchers and support services providers evaluating and describing the importance of various current Trends, rating future New Areas of Focus, and providing open-comment qualitative input on the expected (and hoped-for) direction of financial inclusion progress.

The survey had two main sections: in Section 1, respondents rated from 1-10 the current importance of a list of 20 Trends and evaluated a list of 16 future New Areas of Focus to rank their highest five in terms of future significance. Optional comments on each were possible. Section 2 had three optional and open-ended questions, with a focus on the impact of the pandemic.

The Compass received 125 responses from 39 countries. A plurality of respondents were FSPs, followed by consultants/support services providers, infrastructure organisations, funders and researchers. On the main geographic focus of respondents’ work, a plurality selected Global, followed by Sub-Saharan Africa, Asia and Latin America.

Trends

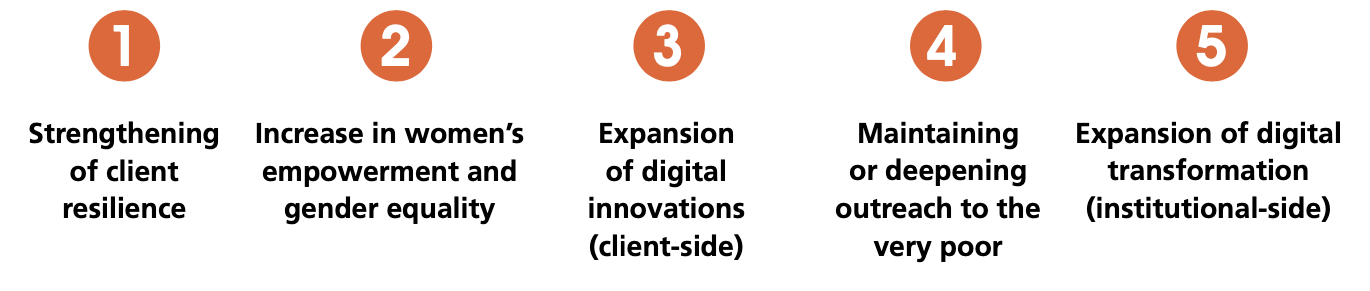

Two new trends, introduced in response to the uniquely challenging context of the pandemic, took the top two spots in the rankings.

As always, there are significant differences among respondent groups. FSPs rate Strengthening of client resilience as much less important than do other groups, but they put Increase in new investors or funding channels much higher. Consultants believe Promotion of good governance is much more important than others do, while both funders and infrastructure organisations rate Increase in women’s empowerment and gender equality considerably lower than respondents overall. Researchers rate Increase in new categories of financial service provider (fintechs, consumer lenders, banks downscaling) of high importance.

New Areas of Focus

The top three areas of focus are the same as in previous surveys, but the order continues to switch. There are also increases in the rankings for Green finance and decreases for Housing and Energy. Financial literacy (incl. digital literacy), a new entrant, is in a high position at fourth.

FSPs are extremely positive on the future significance of SME finance, but consultants and infrastructure organisations are much less so. By contrast, FSPs rate Climate change adaptation/mitigation much less important in the future than other respondent groups, especially consultants and funders.

In the optional qualitative section of the survey, which generated submissions totaling over 40,000 words, respondents were asked three questions.

First, they were asked what the most significant challenges facing the sector are – and what must be done to meet them. Respondents are clear on the importance of financial inclusion in tackling the health, financial and economic impacts of COVID-19. They are very concerned about the exacerbation of poverty because of the pandemic, with continued uncertainty on its full impact and with bleak overall forecasts. They believe that client resilience (especially that of women) is growing in importance, and they recognise the close interconnection between client, institutional and sector-level resilience – and the feedback loops that exist between them – including how efforts to strengthen resilience at one level can risk undermining it at another. Respondents argue for better coordination and partnerships, especially between providers and governments/regulators, who will have to continue to play a larger role than before. They also see the need to manage the inevitable growth in digital products and channels, catalysed by the pandemic, and the likelihood of many low-touch, branchless delivery models becoming permanent. This march of digitisation continues to divide respondents, many of whom still see digital as a threat to social missions and – particularly after the closure of the Smart Campaign – to client protection.

Respondents were also asked how their roles have changed, individually or as an institution, and what lessons they have learned. There has been, for many, a considerable challenge in retaining value and productivity through a year of remote working and travel restrictions, which have made certain technical assistance and research activities challenging or even impossible. However there have been gains too – from virtual events brining in new participants, to support providers training local experts, to a less tangible sense of “shared focus.” This has been visible in many areas, including the welcome collaboration among funders to meet shared challenges. There is hope that this can persist in a post-COVID-19 sector. It’s important as well to remember the human cost of the pandemic and those who have suffered the most. For FSPs in particular, it has been a year of stress, anxiety and in some cases, grief. An enduring lesson to take from this crisis has been the value of flexibility and institutional agility; think and move fast – but ensure that what is being done has value; be cautious of conflating “activity” with “impact.”

Finally, respondents were asked what changes they would like to see in the sector in the next several years – how can we “build back better”? Respondents hope for reforms in markets and data sharing to increase responsiveness to future crises, including via regulation. They want to see a renewed focus on client-centricity, acknowledging that the impact of the pandemic on poor households and businesses is not fully known, but is enormous. And while the growth of digital may well be both threat and opportunity, it is best met with strengthening of strategic alliances with fintechs, which must be seen as partners and not as adversaries. Finally, there are opportunities for a wholesale “re-think” of the entire financial inclusion system: more demand-oriented, flexible and responsive, getting back to the roots of financial intermediation to develop a sector that works for more people.

Thanks must go to the respondents and everyone else who made this paper possible, and on behalf of e-MFP we hope these high-level summary points encourage you to delve into the details of the paper to see where the sector sees itself now – and where it thinks it will be going.

About the Author: Sam Mendelson is Financial Inclusion Specialist at e-MFP and the lead author of the Compass series.

This feature is part of a sponsored series on European Microfinance Week 2021. MicroCapital has been engaged to promote and report on the conference each year since 2012.

Similar Posts:

- MICROFINANCE PAPER WRAP-UP: “The Financial Inclusion Compass 2022,” by Sam Mendelson, Published by e-MFP

- MICROFINANCE PAPER WRAP-UP: “Assessing the State of Youth Financial Inclusion in Developing Contexts,” by Niclas Benni, Published by FAO

- SPECIAL REPORT: e-MFP Green Inclusive and Climate Smart Finance Action Group Focuses on Capacity Building

- MICROCAPITAL BRIEF: Bankingly, Woodcore Partner to Help FSPs in Africa to Offer Digital Financial Services

- SPECIAL REPORT: How to Achieve Responsible Digital Financial Services: European Microfinance Week Opens