The ninth iteration of this event will explore financial services providers’ delivery of digital services to small and medium-sized enterprises (SMEs), leveraging samples from India and abroad. The forum will cover topics – particularly “ecosystems” – relating to digital finance, international

The ninth iteration of this event will explore financial services providers’ delivery of digital services to small and medium-sized enterprises (SMEs), leveraging samples from India and abroad. The forum will cover topics – particularly “ecosystems” – relating to digital finance, international

Category: Agriculture / Rural Finance

MICROCAPITAL BRIEF: I&M Bank Enables Spenn Mobile App Users to Send Money to Financial Institutions Across Rwanda

Norway’s Spenn Technology recently expanded its partnership with the Rwandan unit of Kenya’s Investments & Mortgages (I&M) Bank to allow users of the Spenn mobile application to send money to any financial services provider in Rwanda, including banks and competing mobile money services. The app’s other features include

Norway’s Spenn Technology recently expanded its partnership with the Rwandan unit of Kenya’s Investments & Mortgages (I&M) Bank to allow users of the Spenn mobile application to send money to any financial services provider in Rwanda, including banks and competing mobile money services. The app’s other features include

MICROCAPITAL BRIEF: Grameen Credit Agricole Foundation Loans $760k to Microfinance Institution Oxus Tajikistan

Grameen Credit Agricole (GCA) Foundation, which has offices in France and Luxembourg, recently lent Oxus Tajikistan, one of three microfinance institution (MFI) affiliates of the France-based Oxus Development Network, local currency approximately equivalent to USD 760,000. The purpose is to

Grameen Credit Agricole (GCA) Foundation, which has offices in France and Luxembourg, recently lent Oxus Tajikistan, one of three microfinance institution (MFI) affiliates of the France-based Oxus Development Network, local currency approximately equivalent to USD 760,000. The purpose is to

MICROCAPITAL BRIEF: Mi-Bospo of Bosnia and Herzegovina Borrowing $2.2m from Grameen Credit Agricole Foundation for Microfinance Lending

Microcredit Foundation Mi-Bospo of Bosnia and Herzegovina recently agreed to borrow EUR 2 million (USD 2.2 million) from the Grameen Credit Agricole (GCA) Foundation, which has offices in France and Luxembourg. Mi-Bospo serves 26,000 clients, mostly women who live in rural areas. Its offerings include

Microcredit Foundation Mi-Bospo of Bosnia and Herzegovina recently agreed to borrow EUR 2 million (USD 2.2 million) from the Grameen Credit Agricole (GCA) Foundation, which has offices in France and Luxembourg. Mi-Bospo serves 26,000 clients, mostly women who live in rural areas. Its offerings include

MICROCAPITAL BRIEF: TASC Borrows $3.5m from Spark+ Africa to Fund 90k Cookstoves, Reduce Carbon Emissions in Rural Zambia

Spark+ Africa Fund, a partnership of Switzerland-based Enabling Qapital and the Dutch NGO Stichting Modern Cooking (SMC), recently lent USD 3.5 million to The African Stove Company (TASC), which is based in Jersey, to sell 90,000 cookstoves in rural Zambia. Spark+ Africa raised the funds from the sale of “several million tons

Spark+ Africa Fund, a partnership of Switzerland-based Enabling Qapital and the Dutch NGO Stichting Modern Cooking (SMC), recently lent USD 3.5 million to The African Stove Company (TASC), which is based in Jersey, to sell 90,000 cookstoves in rural Zambia. Spark+ Africa raised the funds from the sale of “several million tons

MICROCAPITAL BRIEF: Satya of India Borrowing $35m from FMO, Finnfund for Microfinance for Rural Women, Youth – Including to Enable Green Transition

Satya MicroCapital, an India-based microfinance institution (MFI), recently borrowed the local-currency equivalent of USD 25 million from the Dutch development bank Financierings-Maatschappij voor Ontwikkelingslanden (FMO) and USD 10 million from Finnfund, a development finance institution controlled by the government of Finland. The funding is intended to

Satya MicroCapital, an India-based microfinance institution (MFI), recently borrowed the local-currency equivalent of USD 25 million from the Dutch development bank Financierings-Maatschappij voor Ontwikkelingslanden (FMO) and USD 10 million from Finnfund, a development finance institution controlled by the government of Finland. The funding is intended to

MICROCAPITAL BRIEF: EIB Loans $214m to Sicredi for Solar Panels for Households, SMEs in Brazil

Banco Cooperativo Sicredi, a Brazil-based financial cooperative owned by its 6.5 million members, recently agreed to borrow EUR 200 million (USD 214 million) from the EU’s European Investment Bank (EIB). Sicredi plans to use the capital to equip houses and

Banco Cooperativo Sicredi, a Brazil-based financial cooperative owned by its 6.5 million members, recently agreed to borrow EUR 200 million (USD 214 million) from the EU’s European Investment Bank (EIB). Sicredi plans to use the capital to equip houses and

MICROCAPITAL BRIEF: MicroVest Lending $3.4m to Financiera Finexpar for Agriculture, SME Lending in Paraguay

MicroVest, an asset management subsidiary of US-based DAI Global, recently issued a loan of USD 3.4 million to the Paraguay-based microfinance institution (MFI) Financiera Finexpar to support the MFI’s lending activities, specifically the funding of small and medium-sized enterprises (SMEs) engaged in

MicroVest, an asset management subsidiary of US-based DAI Global, recently issued a loan of USD 3.4 million to the Paraguay-based microfinance institution (MFI) Financiera Finexpar to support the MFI’s lending activities, specifically the funding of small and medium-sized enterprises (SMEs) engaged in

MICROFINANCE PAPER WRAP-UP: “Impact of Microcredit on Household Consumption and Assets in Nepal;” by Shalik Ram Pokhrel

Dr Pokhrel hypothesized that microcredit is a sustainable tool for poverty reduction, based on the idea that access to microcredit can improve household income and employment opportunities, thus leading to increases in household consumption and asset ownership. The study employed data from

Dr Pokhrel hypothesized that microcredit is a sustainable tool for poverty reduction, based on the idea that access to microcredit can improve household income and employment opportunities, thus leading to increases in household consumption and asset ownership. The study employed data from

MICROCAPITAL BRIEF: Grameen Crédit Agricole Foundation Loans $3.2m to Faten for Microfinance in Palestine

The Luxembourg-based Grameen Crédit Agricole (GCA) Foundation recently disbursed a local-currency loan approximately equivalent to USD 3.2 million to the microfinance institution (MFI) Palestine for Credit and Development, which is also known by its Arabic name Faten. Founded in 1999 and based in Palestine’s West Bank, Faten is an NGO that seeks to

The Luxembourg-based Grameen Crédit Agricole (GCA) Foundation recently disbursed a local-currency loan approximately equivalent to USD 3.2 million to the microfinance institution (MFI) Palestine for Credit and Development, which is also known by its Arabic name Faten. Founded in 1999 and based in Palestine’s West Bank, Faten is an NGO that seeks to

MICROFINANCE EVENT: Sankalp West Africa Summit; June 12-13, 2023; Accra, Ghana

This event will focus on mechanisms through which entrepreneurial partnerships in regions such as South Asia, Southeast Asia and Africa, can solve global issues. The organizers expect approximately 80 speakers and 300 delegates discussing topics such as: (1) Agriculture; (2) Climate Change and Clean Energy;

This event will focus on mechanisms through which entrepreneurial partnerships in regions such as South Asia, Southeast Asia and Africa, can solve global issues. The organizers expect approximately 80 speakers and 300 delegates discussing topics such as: (1) Agriculture; (2) Climate Change and Clean Energy;

MICROCAPITAL BRIEF: Araratbank of Armenia, FMO Ink $10m Risk-sharing Facility to Boost MSMEs

The Armenian bank Araratbank and Dutch development bank Financierings-Maatschappij voor Ontwikkelingslanden (FMO) recently agreed to expand their risk-sharing facility by USD 10 million. FMO’s portion of the commitment is from its Nasira Fund, which guarantees

The Armenian bank Araratbank and Dutch development bank Financierings-Maatschappij voor Ontwikkelingslanden (FMO) recently agreed to expand their risk-sharing facility by USD 10 million. FMO’s portion of the commitment is from its Nasira Fund, which guarantees

SPECIAL REPORT: Small Is Beautiful – Sustainable Agriculture Finance

What financial institutions can do to help poor smallholder farmers secure their livelihoods and make their communities more climate-resilient

Big in numbers, small in size

When German-born British economist E F Schumacher published his book Small Is Beautiful in 1973, he proposed an alternative to the mainstream economic principle of “bigger is better.” Mr Schumacher was an early proponent of sustainable development, demanding that people and planet should matter more than mere profits.

Agriculture plays a key role in global and local sustainable development. It is not an exaggeration to say: Farming is everyone’s business! Just think about the following mind-blowing facts:

- The world population will reach 10 billion by the year 2050, and global food demand will increase by some 50 percent by then.

- 30 percent of global food production is wasted after harvest.

- Every year, we lose almost 1 percent of global farmland due to environmental degradation.

- 26 percent of global greenhouse gas emissions, which cause climate change, come from the food sector.

- Up to 2,000 species of wild animals and plants are estimated to become extinct each year, and agriculture is a main driver of this biodiversity loss.

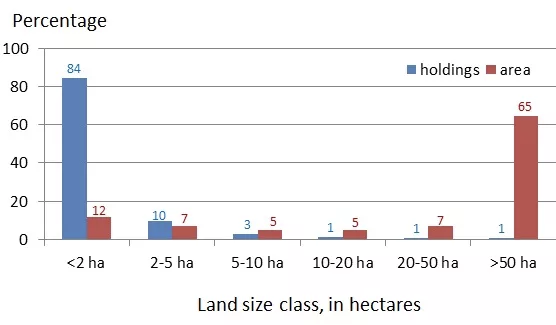

- There are an estimated 570 million farms worldwide, 84 percent of which are smallholdings with less than 2 hectares of land (equivalent to a plot of 200 meters by 100 meters).

- Smallholder farms comprise only 12 percent of all agricultural land on our planet, but still produce roughly one third of the world’s food.

Distribution of the world’s farms and farmland area by land size class.

Source: CGAP.

Why do smallholder farmers matter?

To consider sustainability in all its

MICROFINANCE EVENT: Asia Pacific Microfinance Forum; October 17-18, 2023; Kuala Lumpur, Malaysia

This event, in its fourth edition, aims to facilitate networking among investors and retail financial institutions. With a focus on market trends, the forum will address topics such as: (1) Recent Developments in Responsible Inclusive Finance; (2) Strategies to Overcome

This event, in its fourth edition, aims to facilitate networking among investors and retail financial institutions. With a focus on market trends, the forum will address topics such as: (1) Recent Developments in Responsible Inclusive Finance; (2) Strategies to Overcome

MICROCAPITAL BRIEF: Arnur Credit of Kazakhstan Borrows $3.3m from Grameen Crédit Agricole to Expand Access to Microfinance

The Luxembourg-based Grameen Crédit Agricole (GCA) Foundation recently loaned EUR 3 million (USD 3.3 million) to Arnur Credit, a microfinance institution (MFI) that operates in southern Kazakhstan. Arnur provides

The Luxembourg-based Grameen Crédit Agricole (GCA) Foundation recently loaned EUR 3 million (USD 3.3 million) to Arnur Credit, a microfinance institution (MFI) that operates in southern Kazakhstan. Arnur provides

MICROFINANCE EVENT: Global Forum on Remittances, Investment and Development (GFRID); June 14-16, 2023; Nairobi, Kenya

The eighth edition of this biennial event will begin with two days of sessions with titles such as: (1) Remittances and Diaspora Investment as Tools for

The eighth edition of this biennial event will begin with two days of sessions with titles such as: (1) Remittances and Diaspora Investment as Tools for

MICROCAPITAL BRIEF: Oxfam, Goodwell Launch Pepea, $23m Fund to Invest in SMEs in East Africa

Two Netherlands-based organizations, the NGO Oxfam Novib and for-profit Goodwell Investments recently partnered to create Pepea Fund, with EUR 20 million (USD 22.8 million) from Oxfam Novib to support small and medium-sized enterprises (SMEs) in Kenya, Ethiopia and Uganda. Goodwell Investments will

Two Netherlands-based organizations, the NGO Oxfam Novib and for-profit Goodwell Investments recently partnered to create Pepea Fund, with EUR 20 million (USD 22.8 million) from Oxfam Novib to support small and medium-sized enterprises (SMEs) in Kenya, Ethiopia and Uganda. Goodwell Investments will

MICROCAPITAL BRIEF: Equity for Tanzania, New Holland to Lease Tractors to Small-scale Farmers

The Italy-based equipment manufacturer New Holland recently collaborated with leasing company Equity for Tanzania (EFTA) to deliver 200 tractors to Tanzania in an effort to enhance mechanization among small-scale farmers, improve agricultural productivity and strengthen food security. The effort includes

The Italy-based equipment manufacturer New Holland recently collaborated with leasing company Equity for Tanzania (EFTA) to deliver 200 tractors to Tanzania in an effort to enhance mechanization among small-scale farmers, improve agricultural productivity and strengthen food security. The effort includes