Human  resources (HR) is a critical success factor for financial institutions to become – and remain – competitive in a changing and increasingly complex business environment. Although most institutions would agree that HR functions – recruitment, onboarding, performance management, training and development, among others – are important, some questions remain: How can HR functions be carried out in a strategic and sustainable way? Are MFIs in a strong position to develop and retain the workforce they need to pursue their business and social objectives? How can they strengthen their capacity in these areas?

resources (HR) is a critical success factor for financial institutions to become – and remain – competitive in a changing and increasingly complex business environment. Although most institutions would agree that HR functions – recruitment, onboarding, performance management, training and development, among others – are important, some questions remain: How can HR functions be carried out in a strategic and sustainable way? Are MFIs in a strong position to develop and retain the workforce they need to pursue their business and social objectives? How can they strengthen their capacity in these areas?

The lack of recent global data on MFIs’ HR management practices has made it difficult to answer these questions. To address this, the European Microfinance Platform’s (e-MFP’s) HR Action Group has conducted a large-scale survey of financial inclusion professionals to map out the current landscape of HR practices among MFIs and to shed light on the relationship between HR practices and MFI performance. e-MFP therefore is pleased to share the result of this work by launching “Human Resource Development Practices in the Microfinance Sector,” written by Cheryl Frankiewicz in collaboration with the Action Group, whose members include the International Labour Organization, the Academy of German Cooperatives (ADG), the Social Performance Task Force, ADA, the Microfinance Centre, Triple Jump and Incofin.

In the early years of modern microfinance, MFIs were smaller and were typically NGOs with a social mission, with loan officers acting as a crucial element to guarantee proximity to and trust of clients. As the sector grew, NGOs became banks, digital players entered the sector, and the HR needs of the institutions changed and became more complex – but without any recent information on global HR practices and trends. The HR Action Group’s survey seeks to fill this information gap by offering insights that can shape standards related to human resource development (HRD) and build HRD capacity in financial institutions that provides a strategic and sustainable impact on their financial and social performance.

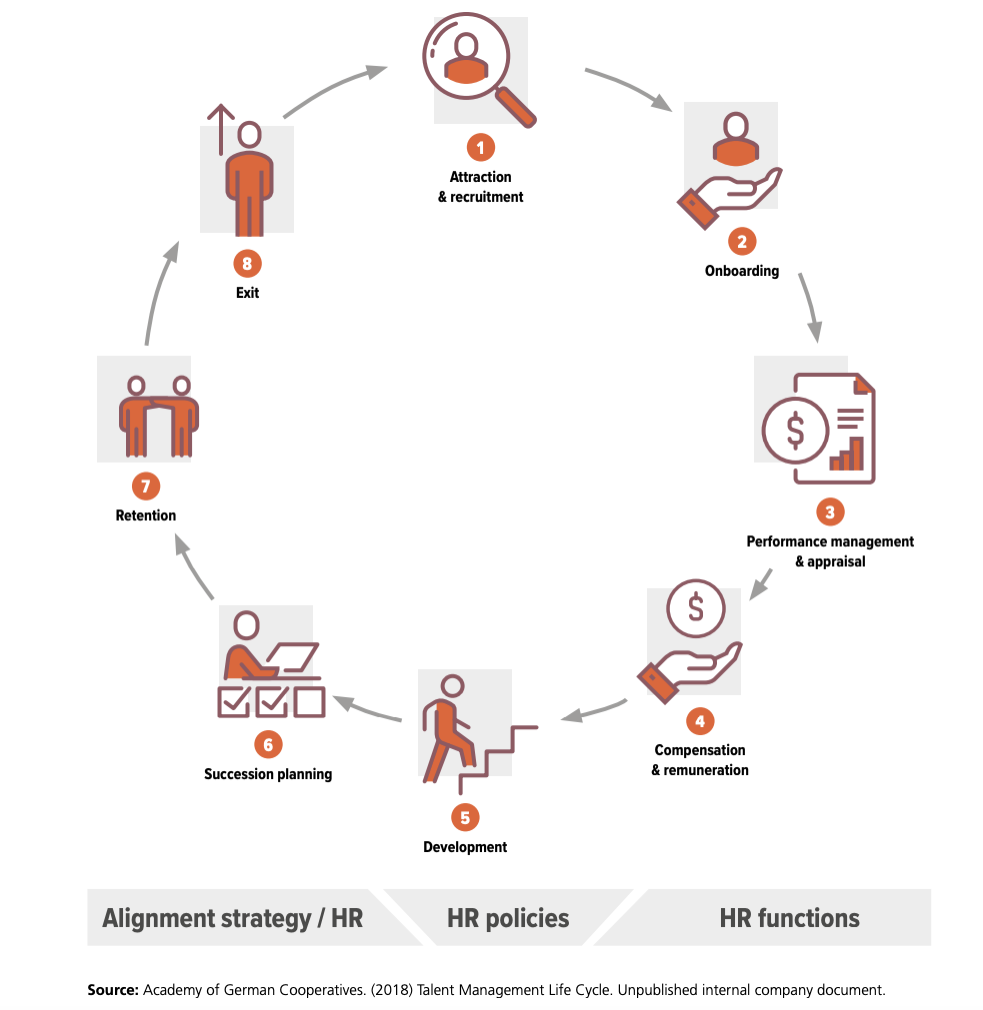

“Human Resource Development Practices in the Microfinance Sector” is based on a survey of MFIs that builds upon the Talent Management Life Cycle (TMLC), a tool developed by ADG that systematizes the elements of HR management and the connections among them. The TMLC, illustrated here , follows the typical life cycle of an employee. The 68-question survey broadly tracks this cycle, exploring HR practices in each stage of the life cycle and integrating HR-related practices from the Universal Standards of Social Performance Management where relevant. It was administered via Survey Monkey in six languages from late November 2020 to the end of February 2021.

, follows the typical life cycle of an employee. The 68-question survey broadly tracks this cycle, exploring HR practices in each stage of the life cycle and integrating HR-related practices from the Universal Standards of Social Performance Management where relevant. It was administered via Survey Monkey in six languages from late November 2020 to the end of February 2021.

The Action Group received 342 survey responses, of which 195 comprised the valid data set. The respondents were from 56 countries representing all regions, as well as diverse organisational types and sizes.

The findings of the paper are comprehensive, as one would expect from an initiative of this complexity. However, there are key takeaways for any stakeholder interested in this subject, including five “opportunities for action”:

1. Strengthening the alignment between HRD and business strategy

A lack of both HR management capacity and financial resources are identified by survey respondents as the two main constraints to HRD. These can only be addressed if MFIs’ leaders believe that HRD has a strategic role to play in achieving the institutions’ goals.

2. Monitoring the cost effectiveness of HRD activities

HR professionals need to be able to provide decision makers with information on both the cost and the effectiveness of HRD initiatives. However, survey results show that this information is seldom gathered, and – too often – what is gathered is not being analysed. Data must be both collected and used effectively for it to have value.

3. Engaging employees

MFIs want employees who are committed and motivated to achieve organizational goals. Bringing people into an MFI whose priorities already align with the institution’s mission and values is good practice. Remuneration and rewards are also necessary, but it seems to be workplace culture and relationships that keep people engaged in the long term.

4. Supporting managers in their HRD roles

Most respondents rely significantly on managers to implement the functions of performance management and learning & development, yet only one third of respondent MFIs provide managers with both HRD targets and training on how to assess skills and provide feedback. Training and supporting managers in their HRD functions is vital.

5. Gauging the strength of current HDR practice

The relationship between HRD and performance is complex, and not all factors that influence it are well understood. Nevertheless, it is possible to identify some factors that can be incorporated into any due diligence process. The paper presents 10 potential indicators to assess the strength of an MFI’s HRD practice. Some of these have been a priority only for a minority of respondents; others are already widely implemented.

We hope that the survey and this new paper present an opportunity for many financial institutions to assess and reflect on their current HR practices and benchmark them against the sector. We further hope it can facilitate self-reflection and discussion within MFIs and other stakeholders to improve their HR practices. Indeed, the feedback received from some of the participating MFIs is that the survey itself has already supported the review of their HR strategies.

The report would not have been possible without the collaboration of the e-MFP Secretariat and the HR Action Group’s individual and institutional members, all of which were indispensable to the design, implementation and promotion of the survey. Finally, the HR Action Group is especially grateful for the excellent support of consultant Cheryl Frankiewicz – and of course all of the organisations that took part, contributing the effort and time to so comprehensively share their experiences.

By Joana Silva Afonso, Financial Inclusion Specialist & Action Group Coordinator, e-MFP, and Sam Mendelson, Financial Inclusion Specialist, e-MFP

This feature is part of a sponsored series on European Microfinance Week 2021, which will take place online from November 17 through November 19. The event is held annually by e-MFP, which has engaged MicroCapital to promote and report on the conference each year since 2012.

Additional Resources

European Microfinance Platform (e-MFP) homepage

https://www.e-mfp.eu/

MicroCapital coverage of the upcoming and past European Microfinance Weeks, including the European Microfinance Award

https://www.microcapital.org/category/european-microfinance-week/

Similar Posts:

- MICROFINANCE EVENT: European Microfinance Week; November 15-17, 2023; Luxembourg

- SPECIAL REPORT: European Microfinance Week 2023 Opens With Action Group Meetings, Including Investors Sharing Strategies for Measuring Social Performance #EMW2023

- SPECIAL REPORT: e-MFP Green Inclusive and Climate Smart Finance Action Group Focuses on Capacity Building

- MICROFINANCE PAPER WRAP-UP: “The Financial Inclusion Compass 2022,” by Sam Mendelson, Published by e-MFP

- SPECIAL REPORT: e-MFP Launches the Green Map, a Pioneering Resource to Address an Information Gap in Green Inclusive Finance