The US-based impact investing firm MicroVest recently selected Michael Apel as its new CEO and Chief Investment Officer. In taking on these roles, Mr Apel will be in charge of the company’s daily operations, including entering into new markets to expand the company’s deployment of private capital to boost micro-, small and medium-sized enterprises (MSMEs). Mr Apel has 25 years of experience at IDB Invest,

The US-based impact investing firm MicroVest recently selected Michael Apel as its new CEO and Chief Investment Officer. In taking on these roles, Mr Apel will be in charge of the company’s daily operations, including entering into new markets to expand the company’s deployment of private capital to boost micro-, small and medium-sized enterprises (MSMEs). Mr Apel has 25 years of experience at IDB Invest,

Tag: Sustainability

SPECIAL REPORT: Inclusivity in Capital Markets Demands Sustainability Reporting

Sustainability reporting entails assessing, disclosing and managing an organization’s environmental, social and governance (ESG) impacts. This practice communicates to investors, customers, employees and regulators that the organization is committed to sustainability. The disclosure element, in particular, conveys values, strategies, risks, opportunities, accountability and transparency.

Sustainability reporting entails assessing, disclosing and managing an organization’s environmental, social and governance (ESG) impacts. This practice communicates to investors, customers, employees and regulators that the organization is committed to sustainability. The disclosure element, in particular, conveys values, strategies, risks, opportunities, accountability and transparency.

The significance of sustainability reporting within capital markets is increasing steadily, as more investors

MICROFINANCE EVENT: Global Development Conference on Biodiversity and Sustainable Development; October 31 – November 1, 2023; Quito, Ecuador

Sessions at this event will cover topics such as aligning government policies with environmental science; supporting female entrepreneurs; how biodiversity impacts economies; and understanding the connections among climate change, poverty, and gender inequality.

Sessions at this event will cover topics such as aligning government policies with environmental science; supporting female entrepreneurs; how biodiversity impacts economies; and understanding the connections among climate change, poverty, and gender inequality.

MICROFINANCE PAPER WRAP-UP: “Predictors of Microfinance Sustainability: Empirical Evidence from Bangladesh,” by Maeenuddin et al

This article examines the financial sustainability of microfinance institutions (MFIs) in Bangladesh. Using data from the MIX Market database, the authors develop a

This article examines the financial sustainability of microfinance institutions (MFIs) in Bangladesh. Using data from the MIX Market database, the authors develop a

MICROCAPITAL BRIEF: Sanad Fund for MSME Raises $26m from ASN Bank, Calvert Impact to Boost Financial Inclusion, Resilience in MENA

The Luxembourg-domiciled Sanad Fund for MSME recently agreed to borrow EUR 15 million (USD 16.5 million) from Algemene Spaarbank voor Nederland (ASN) Bank, a retail banking member of the Netherlands’ de Volksbank, and USD 10 million from the US-based NGO Calvert Impact Capital. Sanad intends to use the fresh funds to facilitate

The Luxembourg-domiciled Sanad Fund for MSME recently agreed to borrow EUR 15 million (USD 16.5 million) from Algemene Spaarbank voor Nederland (ASN) Bank, a retail banking member of the Netherlands’ de Volksbank, and USD 10 million from the US-based NGO Calvert Impact Capital. Sanad intends to use the fresh funds to facilitate

SPECIAL REPORT: Small Is Beautiful – Sustainable Agriculture Finance

What financial institutions can do to help poor smallholder farmers secure their livelihoods and make their communities more climate-resilient

Big in numbers, small in size

When German-born British economist E F Schumacher published his book Small Is Beautiful in 1973, he proposed an alternative to the mainstream economic principle of “bigger is better.” Mr Schumacher was an early proponent of sustainable development, demanding that people and planet should matter more than mere profits.

Agriculture plays a key role in global and local sustainable development. It is not an exaggeration to say: Farming is everyone’s business! Just think about the following mind-blowing facts:

- The world population will reach 10 billion by the year 2050, and global food demand will increase by some 50 percent by then.

- 30 percent of global food production is wasted after harvest.

- Every year, we lose almost 1 percent of global farmland due to environmental degradation.

- 26 percent of global greenhouse gas emissions, which cause climate change, come from the food sector.

- Up to 2,000 species of wild animals and plants are estimated to become extinct each year, and agriculture is a main driver of this biodiversity loss.

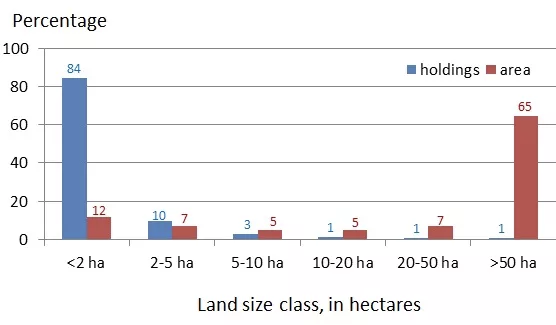

- There are an estimated 570 million farms worldwide, 84 percent of which are smallholdings with less than 2 hectares of land (equivalent to a plot of 200 meters by 100 meters).

- Smallholder farms comprise only 12 percent of all agricultural land on our planet, but still produce roughly one third of the world’s food.

Distribution of the world’s farms and farmland area by land size class.

Source: CGAP.

Why do smallholder farmers matter?

To consider sustainability in all its

MICROFINANCE PAPER WRAP-UP: “Sustainable Finance in the MENA Region;” by Natalia Realpe Carrillo, Alexander Reviakin; Published by Sanad Fund for MSME Technical Assistance Facility, HEDERA Sustainable Solutions

This report examines the sustainable finance ecosystem in the Middle East and North Africa (MENA) region, including the capabilities of microfinance institutions (MFIs) in the region to contribute to climate change adaptation and mitigation. The objectives were

This report examines the sustainable finance ecosystem in the Middle East and North Africa (MENA) region, including the capabilities of microfinance institutions (MFIs) in the region to contribute to climate change adaptation and mitigation. The objectives were

MICROFINANCE EVENT: Sustainability Week; March 29-31, 2023; London, United Kingdom

This eighth annual Sustainability Week is intended to help businesses, policymakers, investors and NGOs achieve their sustainability goals more quickly. The event offers

This eighth annual Sustainability Week is intended to help businesses, policymakers, investors and NGOs achieve their sustainability goals more quickly. The event offers

MICROCAPITAL BRIEF: Symbiotics Raises $4.6m via Green Bond for Samunnati Financial for Sustainable Agriculture in India

India’s  Samunnati Financial Intermediation & Services, whose customers are farmer-producer organizations and other members of agricultural value chains, recently raised the rupee-equivalent of USD 4.6 million in a bond issue handled by Symbiotics, a Switzerland-based impact investing platform. The bond transaction is the first by Symbiotics that specifically promotes

Samunnati Financial Intermediation & Services, whose customers are farmer-producer organizations and other members of agricultural value chains, recently raised the rupee-equivalent of USD 4.6 million in a bond issue handled by Symbiotics, a Switzerland-based impact investing platform. The bond transaction is the first by Symbiotics that specifically promotes

MICROFINANCE EVENT: Impact Investing World Forum; September 23-24, 2021; London, UK, with Virtual Option

The  Impact Investing World Forum (IIWF) is focused on investments that are in line with concerns such as environmental, social and governance (ESG) criteria and the UN Sustainable Development Goals. The event will feature speakers from

Impact Investing World Forum (IIWF) is focused on investments that are in line with concerns such as environmental, social and governance (ESG) criteria and the UN Sustainable Development Goals. The event will feature speakers from

MICROCAPITAL BRIEF: IFC Approves $20m Loan to Agrofértil of Paraguay to Support Farming, Gender Equality Amid COVID-19 Downturn

The  International Finance Corporation (IFC), a member of the World Bank Group, recently agreed to loan up to USD 20 million in working capital to Agrofértil, a company that provides credit, crop insurance, agricultural inputs and “agronomic services” to farmers and farmer cooperatives in Paraguay. Through the loan, which may be renewed yearly for five years, IFC aims to support Agrofértil in its work with farmers cultivating small and medium-sized plots including by endeavoring to “promote

International Finance Corporation (IFC), a member of the World Bank Group, recently agreed to loan up to USD 20 million in working capital to Agrofértil, a company that provides credit, crop insurance, agricultural inputs and “agronomic services” to farmers and farmer cooperatives in Paraguay. Through the loan, which may be renewed yearly for five years, IFC aims to support Agrofértil in its work with farmers cultivating small and medium-sized plots including by endeavoring to “promote

MICROCAPITAL BRIEF: AECID, COFIDES Launch $71m TIF Program Targeting Financial Inclusion, Sustainability in Latin America

Compañia Española de Financiación del Desarrollo (COFIDES), a development finance institution controlled by the Spanish government, recently unveiled a new program called Triple Bottom Line Inclusive Finance in Latin America (TIF), in collaboration with the Agencia Española de Cooperación Internacional para el Desarrollo (AECID), a unit of the government of Spain. TIF aims to support low-income populations in Latin America by increasing access to loans while

MICROCAPITAL BRIEF: IDB Invest, DFC, FinDev Canada Loan $390m to Davivienda of Colombia for SMEs, Environmental Sustainability, Women

IDB Invest, a member of the US-based Inter-American Development Bank (IDB) Group; the US International Development Finance Corporation (DFC); and FinDev Canada, a subsidiary of government-owned Export Development Canada, recently issued subordinated loans totaling USD 390 million to Colombia’s Banco Davivienda for repayment over 10 years. The deal will “provide new financing for work

MICROCAPITAL BRIEF: Overseas Private Investment Corporation (OPIC) Loans $10m to FinLux ELLEN Sarl to Promote Solar Electricity Access in Chad in Partnership with Bren-Tronics

The Overseas Private Investment Corporation (OPIC), the development finance institution of the US government, recently loaned USD 10 million to FinLux E Longlife Energies Nouvelles (ELLEN), a firm registered in France, to distribute solar-powered devices to households, small businesses, medical clinics and educational institutions in Chad. To minimize the upfront cost to users, “the Project Company will retain ownership” of the devices.

MICROCAPITAL BRIEF: IFC to Loan $50m to Itaú Argentina for SMEs, “Green” Lending

The International Finance Corporation (IFC), a member of the World Bank Group, recently agreed to provide Itaú Argentina, a subsidiary of Brazil-based Itaú Unibanco, with USD 15 million to expand funding for small and medium-sized enterprises (SMEs) as well as USD 35 million for “sustainable” energy projects.

MICROCAPITAL BRIEF: Calvert Impact Loans $5m to One Acre Fund for Agricultural Inputs, Clean-energy Equipment Leasing to Smallholder Farmers in East Africa

Calvert Impact Capital, a US-based NGO that raises funds for organizations with “a social and/or environmental focus,” recently loaned USD 5 million to One Acre Fund, a US-based NGO active in the agriculture sector in Africa.

MICROCAPITAL BRIEF: IDB Disburses $148m for Energy-efficiency Projects for Small, Medium-sized Enterprises (SMEs) in Argentina, El Salvador, Paraguay via UN’s Green Climate Fund

With funds drawn from the Green Climate Fund (GCF), a UN-managed investment vehicle for mitigating the effects of climate change, the Inter-American Development Bank (IDB), a member of the US-based IDB Group, recently made three loans totaling USD 140 million to finance energy-efficiency projects undertaken by small and medium-sized enterprises (SMEs) in Latin America.

MICROCAPITAL BRIEF: EBRD Loans $29m to Turkish Leasing Firm QNB Finans Finansal Kiralama for Energy-efficiency Investments

The European Bank for Reconstruction and Development (EBRD), a UK-based multilateral institution, recently loaned EUR 25 million (USD 29 million) to Qatar National Bank Finans Finansal Kiralama (QNB Finans Leasing), a subsidiary of the Turkish commercial bank, QNB Finansbank.