This article is sponsored by Agents for Impact (AFI). We invite you to learn more about the firm via LinkedIn.

Andrij Fetsun, Founder & CEO at AFI:

Andrij Fetsun, Founder & CEO at AFI:

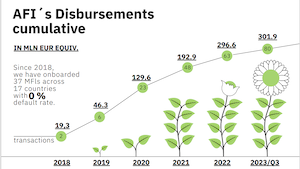

AFI celebrated five years in business in October this year, and my team has attained several impactful goals during this challenging time. This would not have been possible without the immense support of our clients: the German impact-driven microfinance fund Invest in Visions, which has accumulated a volume of around EUR 1 billion with a major focus on microfinance; HANSAINVEST, which is based in Hamburg; and the crowdfunding platform Lendahand. Among the services we provide these clients is to perform plausibility checks of their funds’ ESG reports.

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

This report provides insight into the experience of financial services provider (FSP) clients, including quantitative comparisons of FSPs across regions and snapshots of FSP performance in Cambodia, Ecuador, India, Indonesia and Uganda.

This report provides insight into the experience of financial services provider (FSP) clients, including quantitative comparisons of FSPs across regions and snapshots of FSP performance in Cambodia, Ecuador, India, Indonesia and Uganda. Dr Pokhrel hypothesized that microcredit is a sustainable tool for poverty reduction, based on the idea that access to microcredit can improve household income and employment opportunities, thus leading to increases in household consumption and asset ownership. The study employed data from

Dr Pokhrel hypothesized that microcredit is a sustainable tool for poverty reduction, based on the idea that access to microcredit can improve household income and employment opportunities, thus leading to increases in household consumption and asset ownership. The study employed data from