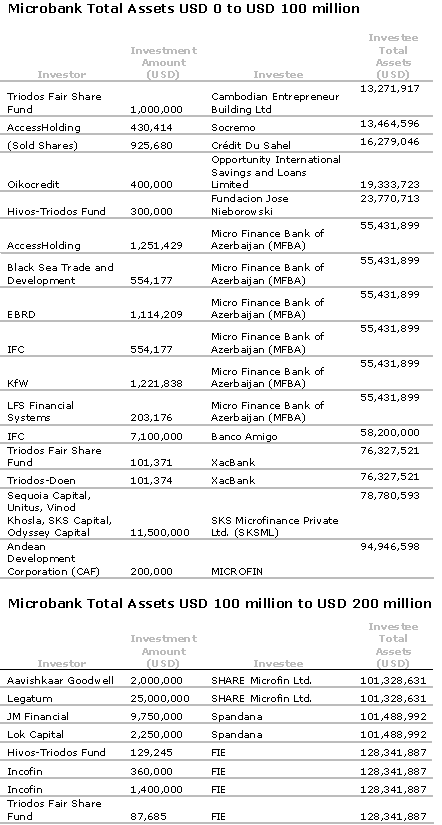

On December 5, MicroCapital.org featured Part 1 of a series on 2007 Equity Investments in Small and Medium Sized Microbanks. Here, in Part 2, we provide detailed financial and outreach information on microbank’s with total assets under USD 100 million. The institutions are presented in ascending order based on asset size.

Triodos Fair Share Fund made a USD 1 million investment to Cambodian Entrepreneur Building Limited. Cambodian Entrepreneur Building Limited, a non-bank financial institution founded in 1995, is based in Phnom Penh, Cambodia. According to its recent financial data on MIX, the institution had total assets of equivalent USD 13.2 million and total loans of equivalent USD 12.2 million. The institution’s return on assets was 3.97 percent and its return on equity was 17.18%. Cambodian Entrepreneur Building Limited serviced over 15,000 active borrowers at the end of 2006 of which 97.7 percent per women. The average loan balance was equivalent USD 813. The institution also supports over 500 savers with an average balance of equivalent USD 454. Source: MIX Market

AccessHolding made an investment of USD 430,414 in Socremo. Socremo, Banco de Microfinanças de Moçambique, is a bank in Mozambique, Africa. Per its MIX profile, Socremo was established in 1998 and currently has over 10000 active borrowers and over 8,000 savers. The average loan balance is equivalent USD 972 and the average savings balance is equivalent USD 182. Per its 2006 year end financial data, Socremo had assets of equivalent USD 13.46 million and a total loan portfolio of equivalent USD 9.9 million. Socremo experienced a -2.00 percent return on assets and a return on equity of -6.62 percent. Source: MIX Market

Crédit Du Sahel, an African credit cooperate, sold shares of equivalent USD 925,680. It was founded in 1997. As of its most recent data reported on MIX, the institution supports over 22,000 active borrowers and 45,000 savers. The institution has total assets of equivalent USD 16.2 million and total loans of equivalent USD 9.7 million. Crédit Du Sahel 2006 year end financial statement revealed a return on assets of 0.46 percent and a return of equity of 6.80 percent. Source: MIX Market

Oikocredit made an investment of USD 400,000 in Opportunity International Savings and Loans Limited. Opportunity International Savings and Loans Limited, or Opportunity Ghana, was founded in 2004. It is a non-bank financial institution based in Accra, Ghana. Per its most recent data on MIX, the institution has over 54,692 active borrowers and over 88,000 savers. The average loan balance is equivalent USD 303 and the average savings balance is equivalent USD 58. Per its June 2007 financial data, the institution had assets of equivalent USD 26.4 million and a total loan portfolio of equivalent USD 16.5 million. In 2006, the institution experienced a 4.52 percent return on assets and a return on equity of 13.16 percent. Source: MIX Market

Hivos-Triodos Fund made an investment of USD 300,000 in Fundacion Jose Nieborowski (FJN). FJN, founded in 1993, is a Latin America non-profit organization that promotes rural and urban micro-enterprise through micro-loans. Per most recent data on MIX, the organization has over 22,000 active borrowers of which approximately 53.90% are women. The average loan balance is equivalent USD 907. Per its year end 2006 financial data, FJN had total assets of equivalent USD 23.7 million and total loans of equivalent USD 20.1 million. Its return on assets was 6.28 percent and its return on equity was 28.51 percent. Source: MIX Market

AccessHolding, Black Sea Trade and Development, European Bank for Reconstruction and Development, International Finance Corporation (IFC), KfW, and LFS Financial Systems made investments totally over USD 4.8 million in Micro Finance Bank of Azerbaijan (MFBA). MFBA, founded in 2002, is an Eastern Europe microfinance institution in Azerbaijan. As of its 2006 MIX profile, MFBA has over 16,000 active borrowers and about 800 savers. Its 2006 year end financial data revealed total assets of equivalent USD 55.4 million and total loans of USD 47.2 million. The MFI’s return on assets was -0.93% percent and its return on equity was -5.30 percent. Source: MIX Market

The International Finance Corporation (IFC) invested USD 7.1 million in Banco Amigo. Banco Amigo, formally known as Banco Comercial del Noreste, S.A., is headquartered in Monterrey, Mexico, and opened to the public in May 2007. The bank received its banking license in November 2006. Prior to licensing, it operated as a non-bank financial institution since 2005. Banco Amigo’s June 2007 financial statement reveals total assets equivalent to USD 52.8 million, a debt/equity Ratio of 73 percent, and a -2.9 percent return on equity. Source: Banco Amigo

Triodos Fair Share Fund and Triodos-Doen invested USD 101,371 and USD 101,374 respectively in XacBank. XacBank, a bank based in Mongolia, was founded in 1998. Per its MIX profile, XacBank has over 56,000 active borrowers and over 82,000 savers. The average loan balance is equivalent USD 886 and the average savings balance is equivalent USD 445. XacBank has assets of equivalent USD 76.3 million and a total loan portfolio of equivalent USD 50.2 million. Per XacBank’s 2006 year end financial statement, it experienced a return on assets of 2.45 percent and a return on equity of 17.83 percent. Source: MIX Market

Several firms, lead by Sequoia Capital and Unitus, invested USD 11.5 million in SKS Microfinance Private Limited (SKSML). SKSML is an Indian microfinance institution founded in 1997. Per its most recent data on MIX, as of March 2007 SKSML has over 513,000 active borrowers of which 100 percent are women. The average loan balance for each borrower is equivalent USD 123. Per its March 2007 financial data, SKSML had total assets of equivalent USD 78.7 million and a total loan portfolio of equivalent USD 63.2 million. The institution’s March 2007 financial data revealed a return on assets of 1.75 percent and a return on assets of 9.22 percent. Source: MIX Market

The Andean Development Corporation (CAF) invested USD 200,000 in MICROFIN. MICROFIN, or MIKROFIN Banja Luka, is a non-bank financial institution in Bosnia and Herzegovina. MICROFIN was founded in 1997, and as March 2007 has over 40,000 active borrowers. The average loan balance per borrower is equivalent USD 2,186. Per its most recent financial data on MIX, March 2007, MICROFIN had total assets of equivalent USD 94.9 million and total loans of equivalent USD 89.2 million. Per its 2006 year end financial data, the institution had a return on assets of 4.80 percent and a return on equity of 17.45 percent. Source: MIX Market

MICROCAPITAL SPECIAL FEATURE: 2007 Equity Investments in Small and Medium Sized Microbanks, Part 1 of 3

2007 has proven to be a productive year for international microfinance equity investments in small and medium sized microbanks. The Microfinance Capital Markets (MCM) Newsletter of the Consultative Group to Assist the Poor (CGAP) and the MIX, the microfinance information clearinghouse, reported 25 investments in 13 small and medium sized Microbanks by 21 investors.

The table below summarizes notable equity investments in small and medium sized microbanks, sorted by asset size. In the next few days, we will provide background and financial information on each investee institution.

Similar Posts:

- MICROCAPITAL BRIEF: Annapurna of India Borrows $10m from MicroVest to Expand Microfinance for Rural Women

- MICROCAPITAL BRIEF: IDB Invest, Oikocredit Subscribing to $20m Bond from CJA to Finance MSMEs in Ecuador, Targeting Underrepresented Groups

- MICROCAPITAL BRIEF: FMO Lends $10m to Latin American Agriculture Development Corporation (LAAD) to Boost Green Investment

- MICROCAPITAL BRIEF: OnePuhunan Borrows $10m from MicroVest to Boost Microfinance for Women in the Philippines

- MICROCAPITAL BRIEF: EIB Lends Credo Bank $10m for MSMEs in Georgia