This paper examines how the perception of obesity as a symbol of wealth can yield financial benefits to overweight people in southern Uganda. The author applied computer software to photos of 34 test subjects to create

This paper examines how the perception of obesity as a symbol of wealth can yield financial benefits to overweight people in southern Uganda. The author applied computer software to photos of 34 test subjects to create

Category: Risks

MICROFINANCE PAPER WRAP-UP: “Predictors of Microfinance Sustainability: Empirical Evidence from Bangladesh,” by Maeenuddin et al

This article examines the financial sustainability of microfinance institutions (MFIs) in Bangladesh. Using data from the MIX Market database, the authors develop a

This article examines the financial sustainability of microfinance institutions (MFIs) in Bangladesh. Using data from the MIX Market database, the authors develop a

SPECIAL REPORT: Small Is Beautiful – Sustainable Agriculture Finance

What financial institutions can do to help poor smallholder farmers secure their livelihoods and make their communities more climate-resilient

Big in numbers, small in size

When German-born British economist E F Schumacher published his book Small Is Beautiful in 1973, he proposed an alternative to the mainstream economic principle of “bigger is better.” Mr Schumacher was an early proponent of sustainable development, demanding that people and planet should matter more than mere profits.

Agriculture plays a key role in global and local sustainable development. It is not an exaggeration to say: Farming is everyone’s business! Just think about the following mind-blowing facts:

- The world population will reach 10 billion by the year 2050, and global food demand will increase by some 50 percent by then.

- 30 percent of global food production is wasted after harvest.

- Every year, we lose almost 1 percent of global farmland due to environmental degradation.

- 26 percent of global greenhouse gas emissions, which cause climate change, come from the food sector.

- Up to 2,000 species of wild animals and plants are estimated to become extinct each year, and agriculture is a main driver of this biodiversity loss.

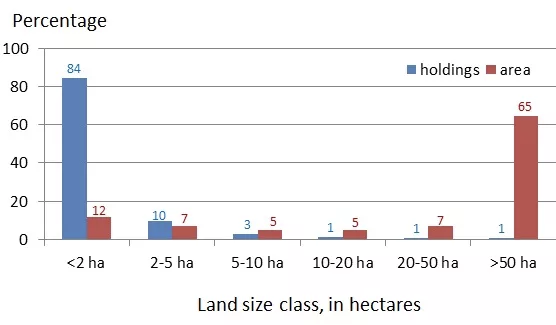

- There are an estimated 570 million farms worldwide, 84 percent of which are smallholdings with less than 2 hectares of land (equivalent to a plot of 200 meters by 100 meters).

- Smallholder farms comprise only 12 percent of all agricultural land on our planet, but still produce roughly one third of the world’s food.

Distribution of the world’s farms and farmland area by land size class.

Source: CGAP.

Why do smallholder farmers matter?

To consider sustainability in all its

MICROFINANCE EVENT: Responsible Finance Forum; July 5-7, 3023; Bengaluru, India

Themed “Shaping a Responsible Digital Finance Ecosystem,” the upcoming edition of this event – the first in-person since 2019 – will focus on client protection to help “low-income and vulnerable” people reduce risks as they use financial tools. Although the detailed agenda has not yet been finalized, it is expected to include topics such as: (1) Balancing Responsible Finance Between

Themed “Shaping a Responsible Digital Finance Ecosystem,” the upcoming edition of this event – the first in-person since 2019 – will focus on client protection to help “low-income and vulnerable” people reduce risks as they use financial tools. Although the detailed agenda has not yet been finalized, it is expected to include topics such as: (1) Balancing Responsible Finance Between

MICROFINANCE EVENT: Global Impact Investing Network (GIIN) Impact Forum; October 4-5, 2023; Copenhagen, Denmark

This event will address sustainable development via impact investing. The agenda offers sessions including: (1) Impact Analytics, Predictive and Optimization tools: What Does “Good” Impact Look Like?; (2) Designing the Future of

This event will address sustainable development via impact investing. The agenda offers sessions including: (1) Impact Analytics, Predictive and Optimization tools: What Does “Good” Impact Look Like?; (2) Designing the Future of

SPECIAL REPORT: Christoph Pausch on the European Microfinance Award 2023 – Inclusive Finance for Food Security & Nutrition

MicroCapital: Why was “Inclusive Finance for Food Security & Nutrition” chosen as the topic of this, the 14th edition of the European Microfinance Award?

MicroCapital: Why was “Inclusive Finance for Food Security & Nutrition” chosen as the topic of this, the 14th edition of the European Microfinance Award?

Christoph Pausch: For a long time, it looked like progress in this field would be positive and continuous. But a combination of factors – among them climate change, the COVID-19 pandemic and the global inflationary context – means that progress in food security and nutrition may have stalled, or in fact reversed. According to the World Food Programme, “Conflict, economic shocks, climate extremes and soaring fertiliser prices are combining to create a food crisis of unprecedented proportions.” And the Food and Agriculture Organization reports that the number of people affected by hunger has grown by 150 million since the onset of the pandemic. But the problem is not only one of hunger – lack of access to sufficient food – it’s also one of insufficient quality, meaning poor nutrition, and lack of access to the micronutrients necessary for good health, all compounded by the stress of uncertain supply. There may be 2 billion people worldwide in this category.

There are many sectors that have to play roles in addressing food security and nutrition. And because the people most vulnerable to food insecurity and malnutrition are largely those who are low-income, living in low-income countries and financially excluded, there is a vital role for the financial inclusion

MICROFINANCE EVENT: Navigating the Future of Impact Investing in Asia; May 9, 2023; Hong Kong, China

Attendees at this conference will debate investing “with the intention to generate social and environmental impact alongside a financial return” in Asia and worldwide. The topics to be covered include: 1) the current status of the sector; 2) methods for

Attendees at this conference will debate investing “with the intention to generate social and environmental impact alongside a financial return” in Asia and worldwide. The topics to be covered include: 1) the current status of the sector; 2) methods for

SPECIAL REPORT: Agents for Impact – We Make Positive Impact Investable!

Founded in 2018, Agents for Impact (AFI) celebrates its fifth anniversary this year. This represents five years of continuous commitment to our mission, which is to build bridges between impact investors and financial services providers in developing markets across the world. Sustainability is central to our vision. We aim to create more investment opportunities by measuring risks (Risk), rendering impact measurable and comparable (Rating), and making sustainability and financial inclusion understandable for investors (Research).

Founded in 2018, Agents for Impact (AFI) celebrates its fifth anniversary this year. This represents five years of continuous commitment to our mission, which is to build bridges between impact investors and financial services providers in developing markets across the world. Sustainability is central to our vision. We aim to create more investment opportunities by measuring risks (Risk), rendering impact measurable and comparable (Rating), and making sustainability and financial inclusion understandable for investors (Research).

To acknowledge our jubilee, we kick off 2023 by looking back at our achievements and bringing some of our milestones to your attention. Since its inception, AFI has provided investment advice and recommendations on around USD 285 million in impact investing transactions. So far, we have done business in 16 countries across the globe, facilitating debt financing to 32 financial institutions (including one more since the December 2022 figures shown in the graph below!) – each of which was analyzed and selected according to strict standards of sustainability, alignment with a number of the UN’s Sustainable Development Goals (SDGs), and

MICROFINANCE EVENT: 25th MFC Annual Conference: Thriving Together; May 24-25, 2023; Budva, Montenegro

This event is organized with the goal of addressing evolving challenges such as climate change, political instability and the “uncertain future of work.” The agenda includes sessions such as: (1) 25th Anniversary Time Travel: Lessons From the Past That Point to

This event is organized with the goal of addressing evolving challenges such as climate change, political instability and the “uncertain future of work.” The agenda includes sessions such as: (1) 25th Anniversary Time Travel: Lessons From the Past That Point to

MICROFINANCE PAPER WRAP-UP: “Microfinance, Over-indebtedness and Climate Adaptation: New Evidence from Rural Cambodia;” by Vincent Guermond et al; Published by Royal Holloway, University of London

The authors of this report argue that microfinance loans in Cambodia are leading to over-indebtedness amongst farmers, inhibiting their ability to adapt to climate change. The aggregate

The authors of this report argue that microfinance loans in Cambodia are leading to over-indebtedness amongst farmers, inhibiting their ability to adapt to climate change. The aggregate

SPECIAL REPORT: Looking Back to Plan Ahead – The Year of AFISAR

AFISAR© (the Agents for Impact Sustainability Alignment Rating) builds trust and credibility in the microfinance sector. With our partners, we engage in an active rating process, inspiring discussion and increasing awareness and understanding of the UN’s SDGs and environmental, social and governance (ESG) factors, taking a deep dive into the potential of finance to transform people’s lives, especially the lives of members of vulnerable groups. Placing active dialogue at the centre of the AFISAR© rating process, we address sustainability with strategic decision-makers and support our partners to further align their operations to the SDGs.

AFISAR© (the Agents for Impact Sustainability Alignment Rating) builds trust and credibility in the microfinance sector. With our partners, we engage in an active rating process, inspiring discussion and increasing awareness and understanding of the UN’s SDGs and environmental, social and governance (ESG) factors, taking a deep dive into the potential of finance to transform people’s lives, especially the lives of members of vulnerable groups. Placing active dialogue at the centre of the AFISAR© rating process, we address sustainability with strategic decision-makers and support our partners to further align their operations to the SDGs.

Having clocked five years of rating experience, culminating with the Year of AFISAR© in 2022, we would like to share some reflections:

Local presence is key Our rating team has grown bigger and stronger: we have a new colleague, Abhinav Soni, who is based in

MICROFINANCE EVENT: Arab Savings & Financial Literacy Conference; October 9-11, 2023; Cairo, Egypt – NEW DATES

This event, which originally was set to begin on May 7, 2023, will focus on the importance of financial literacy and long-term savings in improving household financial stability. It offers in-person and remote access to sessions such as: (1) Reconciling the

This event, which originally was set to begin on May 7, 2023, will focus on the importance of financial literacy and long-term savings in improving household financial stability. It offers in-person and remote access to sessions such as: (1) Reconciling the

MICROCAPITAL BRIEF: B2B Fintech Clowd9 Chooses Netcetera for Payments Security

Clowd9, a UK-based payment processing platform, recently hired the Switzerland-based software company Netcetera to augment its digital payment security. Clowd9 connects

Clowd9, a UK-based payment processing platform, recently hired the Switzerland-based software company Netcetera to augment its digital payment security. Clowd9 connects

MICROCAPITAL BRIEF: CCAF-World Bank Study Finds Regulators in Africa Tops for Increasing Focus on Fintech, Cybersecurity Main Concern Worldwide

A recent survey of 128 financial regulators and supervisors worldwide found that just over half of respondents in low- and middle-income countries have been increasing their focus on financial technology (fintech) firms. The figure is about one out of three in

A recent survey of 128 financial regulators and supervisors worldwide found that just over half of respondents in low- and middle-income countries have been increasing their focus on financial technology (fintech) firms. The figure is about one out of three in

MICROFINANCE EVENT: Microfinance Technology Summit; March 28-29, 2023; Kigali, Rwanda

This event will promote networking among representatives of microfinance institutions (MFIs) and technology firms to leverage innovations that improve

This event will promote networking among representatives of microfinance institutions (MFIs) and technology firms to leverage innovations that improve

MICROFINANCE EVENT: FinovateEurope; March 14-15, 2023; London, UK

This event will focus on financial technology (fintech) that can help financial services providers and their clients to prosper. In addition to 35 product demos, the agenda includes

This event will focus on financial technology (fintech) that can help financial services providers and their clients to prosper. In addition to 35 product demos, the agenda includes

MICROCAPITAL BRIEF: JuST Institute Opens Doors, Promoting Inclusive Finance for Biodiversity, Climate Adaptation

The Just Sustainability Transitions (JuST) Institute, an NGO based in France, recently launched with the mission of supporting financial services providers (FSPs), consultants and both public and private investors in expanding their work “for the benefit of people and the planet.” In particular, the JuST Institute seeks to facilitate investment flows and capacity building services that support farmers and small-business owners in climate adaptation and conserving biodiversity. The NGO’s initial focus is on

The Just Sustainability Transitions (JuST) Institute, an NGO based in France, recently launched with the mission of supporting financial services providers (FSPs), consultants and both public and private investors in expanding their work “for the benefit of people and the planet.” In particular, the JuST Institute seeks to facilitate investment flows and capacity building services that support farmers and small-business owners in climate adaptation and conserving biodiversity. The NGO’s initial focus is on

MICROFINANCE EVENT: SuperReturn Africa; December 5-7, 2022; Cape Town, South Africa

The 13th edition of this event will focus on “market trends, challenges and innovations” in Africa. On December 5, the event will feature summits covering three topics: (1) fundraising; (2) infrastructure; and (3) ESG [environmental, social and governance issues] & impact. The remaining days will

The 13th edition of this event will focus on “market trends, challenges and innovations” in Africa. On December 5, the event will feature summits covering three topics: (1) fundraising; (2) infrastructure; and (3) ESG [environmental, social and governance issues] & impact. The remaining days will